Monthly Market Update - October 15, 2024

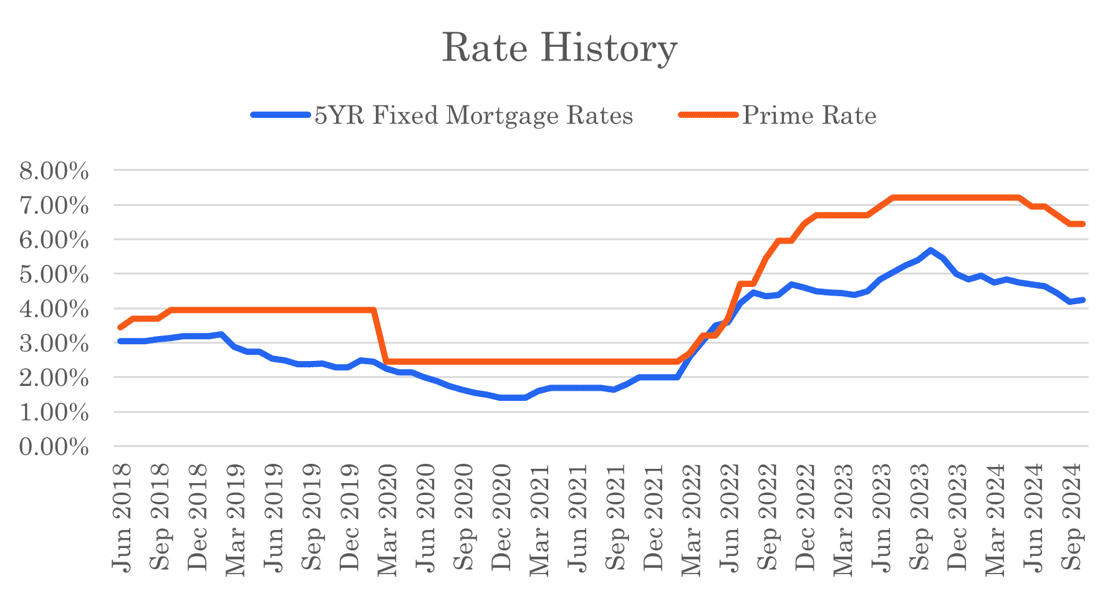

Housing sales have seen a modest increase as rates have dropped, but many buyers may be waiting for additional rate reductions. After a third consecutive rate cut in September, mortgage rates responded by moving lower. However, some stronger-than-expected economic data in early Oct pushed bond yields off their recent lows by close to 0.3%. Fixed mortgage rates rose in response, reverting back to levels seen in early Sept.

While variable mortgage rates will decline whenever the Bank of Canada cuts rates, this recent variability in fixed mortgage rates shows that they may bounce around within a range. We may not see any material declines in fixed mortgage rates in the near future.

Following on some positive rule changes from the Federal Government regarding mortgage insurance, OSFI (the banking regulator) announced the elimination of the mortgage stress test requirement for uninsured mortgage borrowers switching lenders at renewal, starting November 21. This increases flexibility and alternatives at renewal for uninsured mortgage borrowers, bringing the rules on par with those for insured mortgage borrowers.

The Bank of Canada will make an interest rate announcement on October 23. The market expects a rate cut but is split whether it will be a 0.25% or 0.50% rate cut. Inflation data released this morning showed inflation in Sept declining to 1.6%. This is below the Bank of Canada target of 2.0% and may make more room for a larger, 0.50% rate cut next week.

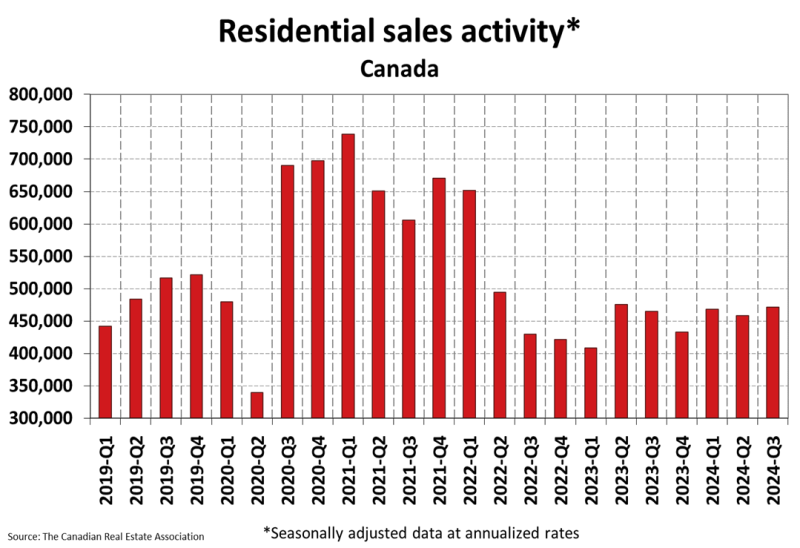

The fall season for the Canadian mortgage and housing markets has started slowly. Further rate cuts and increasing inventories are all good for prospective homebuyers. Near-term activity may be slow to ramp up, but expectations for a healthy spring 2025 market are growing.

Homes for sale inventory continues to build in many major markets. A buyers market is emerging, presenting market entrants with more choice than in prior periods.

The next Bank of Canada rate announcement is scheduled for October 23, 2024 and there is one more this year on December 11, 2024. Expectations are for rate cuts at both announcements.

Five-year bond yields increased in the past month and fixed mortgage rates rose in response. Our best insured, five-year, fixed mortgage rate is now 4.24%.

Variable rates remain high, with our best insured, five-year, variable mortgage rate now at 5.35%. Variable rates will only decline further in response to additional rate cuts by the Bank of Canada.

Mortgage Market

- The prime rate is 6.45%

- Bond yields declined in late Sept but have increased since then and are back to where they were in early Sept. Five-year insured mortgage rates dropped in late Sept but have increased in early Oct. They are now close to where they were in early to mid-Sept. Some lenders have been more aggressive with uninsured mortgage rates and they are lower this month.

- The five year government bond yield is 2.92% today, up from 2.66% last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Fixed and variable mortgage rates have not changed materially in the past month, with the exception of some lenders being more aggressive with uninsured mortgage rates

- Fixed mortgage rates are more than 1% lower than variable mortgage rates

- Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- It is reasonable to expect further rate cuts - BoC

- The Bank of Canada may look at larger rate cuts, up to 50 bps, if the economy underperforms - BoC

- We maintain our call for a 25 bps rate cut in October, but CPI data could be soft enough to sway the BoC to a 50 bps cut - CIBC

- Headline inflation decelerates, with 1.6% inflation reported for September. This solidifies a 50 bps rate cut - BNN Bloomberg

- Five-year fixed mortgage rates unlikely to move lower - Desjardins

- Mortgage hunters are banking on a big drop in rates, but be warned - they could yo-yo - Financial Post

- OSFI eliminates stress test requirement for uninsured mortgage borrowers switching lenders at renewal, starting November 21

- Federal Government changes mortgage insurance rules to encourage more construction of secondary suites and new units to existing homes. A 90% LTV and 30-year am will be permitted for insured mortgages when adding up to a maximum of three additional units for properties valued less than $2 million.

- Mortgage rule changes will help spark demand, but supply challenges persist - Canadian Mortgage Trends

- New mortgage rules will significantly lower down payments on properties costing $1 million or more - Globe & Mail

- Breaking a mortgage for better rates can pay off, but beware the costs - Globe & Mail

- Economy projected to grow moderately; Bank of Canada rates to fall below 3% by mid-2025 - Deloitte

- Inflation in Canada declined to 1.6% in Sept.

Housing Market

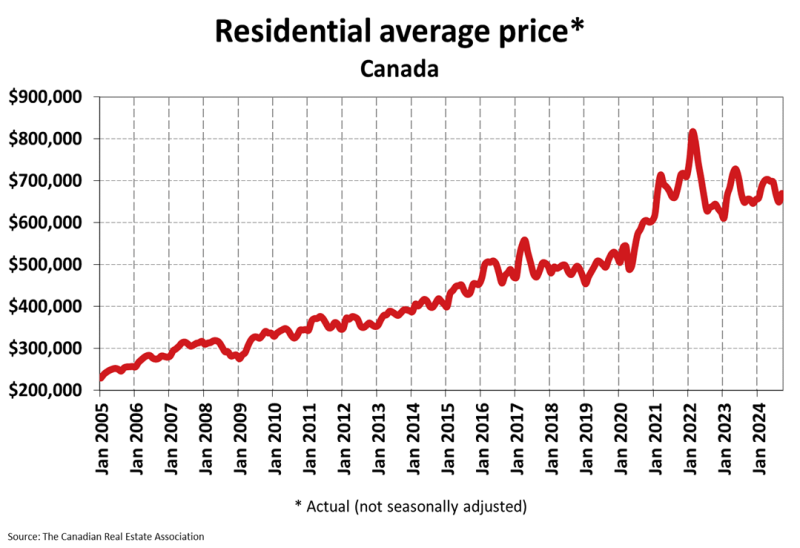

The MLS Home Price Index (HPI) rose slightly by 0.1% month-over-month in September 2024. The actual (not seasonally adjusted) national average sale price was up 2.1% year-over-year. The actual national average home price was $669,630 at the end of September 2024.

Housing Sales increased by 1.9% month-over-month in September 2024. Actual (not seasonally adjusted) sales were up 6.9% over the prior year, September 2023.

Housing Market Headlines

- New listing activity in September rose 4.9% month-over-month - CREA

- Nationally, there were 4.1 months of housing inventory for sale at the end of September 2024. The long-term average is closer to 5 months - CREA

- The beginning of September saw a burst of new supply (listings) for buyers to choose from before things generally quiet down for the winter - CREA

- Canada's sluggish housing market in recovery mode following third straight interest rate cut - Royal LePage

- Real estate developers predict mortgage changes will do little to spur demand for newly built homes - Globe & Mail

- New listings climb in most major markets, except Montreal - RBC

- Condo inventory growing year-over-year, by as much as 50% in BC's Fraser Valley, the GTA and Calgary, as sellers anticipate stronger demand in the spring of 2025 - RE/MAX

- Canada's ban on foreign ownership of housing has not materially impacted prices or market inventory - Royal LePage

- Despite 2024 being one of the strongest first halves for housing starts, it wasn't enough to meet demand - CMHC

- Billions spent in infill and renovation over the pandemic years raised the overall value of residential housing stock and continues to support higher pricing on single-family homes despite downward market pressure in the country's most expensive markets, Toronto and Vancouver - RE/MAX

- Homebuyers may be looking for more rate reductions before returning to the market en masse - Desjardins

- Condo market shaped by investors who prefer smaller units - Vancouver Sun

- Overall sales of luxury homes increased in most markets this year while prices have remained stable - Royal LePage

- The Competition Bureau probe into anti-competitive conduct by the Canadian Real Estate Association received court order to proceed - CBC

- Housing starts were down 2.9% in August - CMHC

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts

Mortgage Brokerage Licensed in Ontario (FSRA #13204), British Columbia, Alberta, Manitoba, Newfoundland & Labrador, and New Brunswick (#230015752).

© Frank Mortgage 2024 | All Rights Reserved