Canadian Mortgage Rate Forecast For 2025

What are Canadian mortgage rates going to do in 2025? We do not have a crystal ball, and the markets are sending mixed signals right now. However, we do think that more rate cuts are coming but are concerned that fixed mortgage rates are near their floor. What might all this mean? – read on.

2025 Mortgage Rate Prediction

We expect variable mortgage rates to decline a further 0.50% to 0.75% in 2025. This will bring them below fixed mortgage rates for the first time since 2022. It is historically the norm for variable mortgage rates to be below fixed mortgage rates. This means five-year variable mortgage rates could be in the range of 3.6% to 4% by the end of the year.

We do not expect much change in fixed mortgage rates in 2025. Bond yields have modest rate cuts already priced in and are resisting further declines. The recent steep increase in the US 10-year bond tells us that the bond market thinks central banks are wrong to cut rates further. We must pay heed to those signals since fixed mortgage rates depend on the bond market. We anticipate five-year fixed mortgage rates to range between 3.8% and 4.5% for most of the year.

We can only rely on market inputs to generate our own expectations for mortgage rates in 2025. Those key inputs include:

- The Bank of Canada has indicated more rate cuts may be coming in 2025, but the pace and size of the cuts will be more gradual;

- Economists are forecasting a weakening Canadian economy. When the economy weakens, the central bank tends to cut rates to provide economic stimulus;

- The US Federal Reserve has stated they are in no rush to cut rates;

- The US 10-year bond has risen by 0.85% since the Federal Reserve began cutting rates in Sept 2024;

- Canadian 5-year bond yields are unchanged since August 2024 and only 0.15% lower than in mid-Jan 2024;

- US Federal Reserve reluctance to cut rates may limit how much the Bank of Canada can cut. When the Bank of Canada cuts rates more than the US does, it hurts the value of the Canadian dollar; and

- Analysts in Canada and the US expect rate cuts in 2025.

There are many risks that are not priced in yet that could materialize. Economic weakness will increase the likelihood of more rate cuts and could even reduce bond yields. Economic strength will eliminate the need for rate cuts and could even lead to higher rates. There are also political and geopolitical risks that are not our place to opine on. They are difficult to predict but could significantly impact our interest rate markets in 2025, a year currently marked by uncertainty.

What Happened to Mortgage Rates in 2024?

The Canadian market entered 2024 with high expectations for multiple Bank of Canada interest cuts, starting as early as March or April. The cuts came a bit later than anticipated, with the first cut on June 5. We saw cuts totaling 1.75% from June through December. The last two cuts, in October and December, were consider ‘jumbo’ cuts of 0.50% (the usual cut is 0.25%).

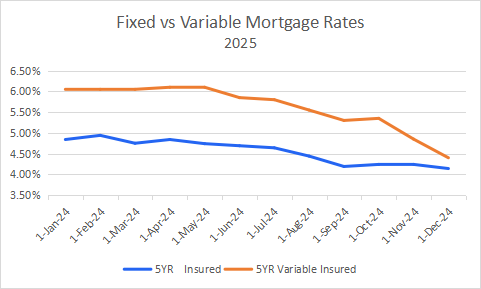

These cuts had the expected direct impact on variable-mortgage rates which dropped by the same amount. Fixed rates are ‘forward-looking’, so they move when expectations change. As the chart below shows, they dropped in anticipation of the cuts but, once the rate cuts gathered steam later in the summer, they remained relatively flat.

Fixed mortgage rates (for insured mortgages) started 2024 at 4.90% and declined to 4.14% by the end of the year – a decline of 0.76%.

Variable mortgage rates (for insured mortgages) started 2024 at 6.15% and declined to 4.40% by the end of the year – a decline of 1.75%. This decline matched the decline in the Bank of Canada’s target rate from 5.0% to 3.25% during the year.

As this past year demonstrates, variable rates move in lockstep with the Bank of Canada. Fixed rates anticipate the Bank of Canada rate movements but since they depend on a multitude of economic and political factors, they do not track the Bank of Canada rate movements.

Variable mortgage rates remain higher than fixed mortgage rates, but that gap is narrowing. Five-year variable mortgage rates are only about 0.25% higher than fixed mortgage rates entering 2025.

What Interest Rates Affect Mortgage Rates?

There are two key underlying market rates that mortgage borrowers should be aware of:

1. The Prime Rate

The prime rate is defined as the interest rate commercial banks charge their most credit-worthy customers. It serves as a benchmark rate for setting the rates on a variety of financial products, including mortgages, personal loans, and lines of credit. The prime rate is influenced by several factors, including inflation, economic growth, and the supply and demand for credit.

The prime rate is determined by the banks themselves, and it is typically set at a level that is 1.5 to 2.5 percentage points above the overnight target rate set by the Bank of Canada. The prime rate is currently (as of Jan 10, 2025) 5.45%.

2. The Five-Year Canada Bond Yield

There are a variety of Canada government bonds that trade daily in the bond market. They have terms to maturity ranging from overnight to 30-year bonds. The five-year Canada bond is a benchmark pricing bond for mortgages. This is because mortgage funding vehicles like mortgage-backed securities are priced off this bond.

The bond market sets the price of the bonds, and the bonds are forward looking. This means their current price is somewhat based on bond investor expectations for the future economic prospects of the country that issued the bonds. Factors like economic growth, employment and inflation influence the price of the bonds. The five-year government of Canada bond yield is currently 3.17% (as of Jan 10, 2025) and was as high as 4.42% in October 2023.

Recent Canadian Interest Rate History

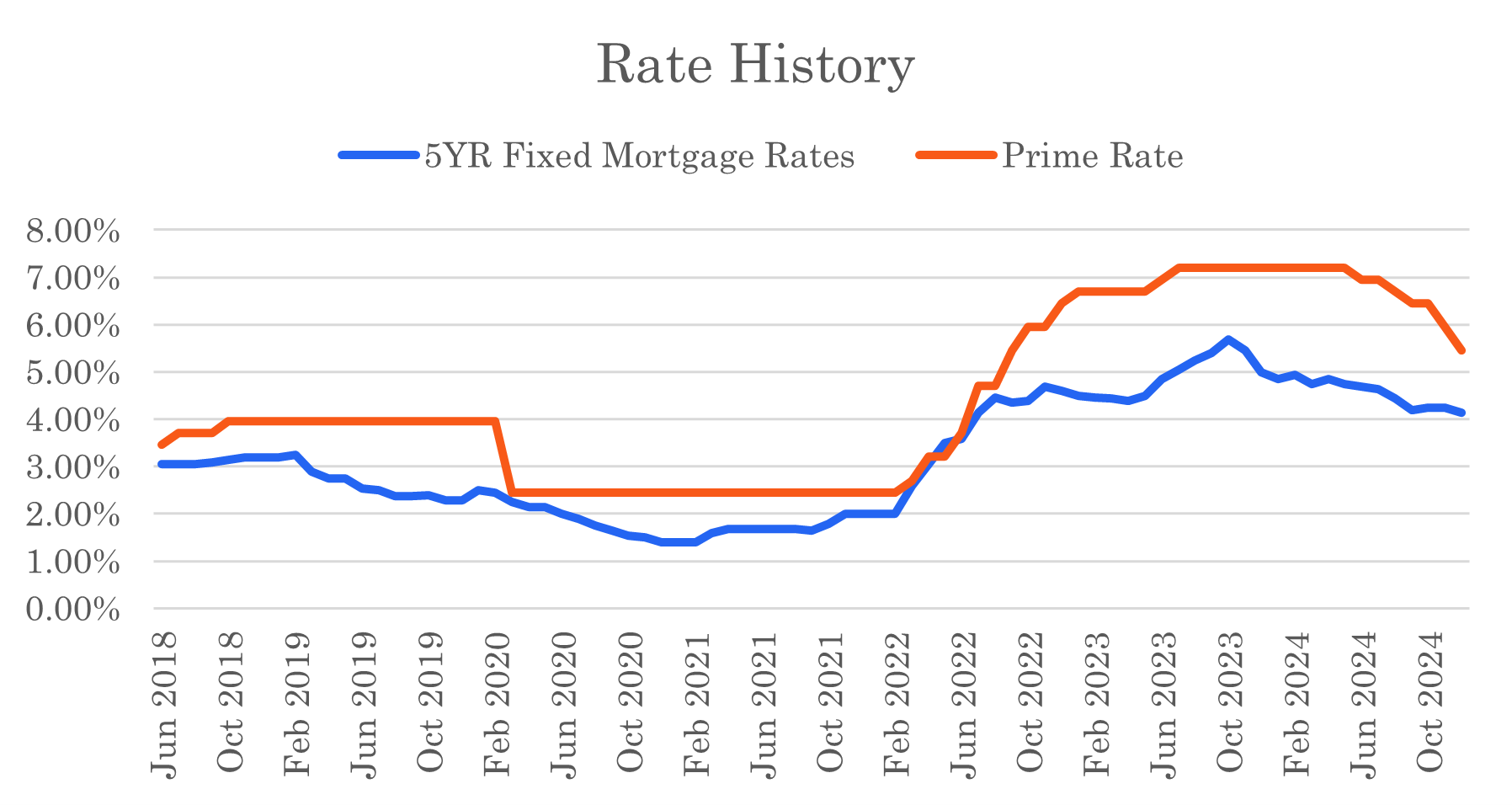

Rates have been lower than historical averages since the economy exited from the 2008-2009 financial crisis. There have been some ups and downs, but central banks held rates low for an unusually long time from 2010 to 2022. Not only had rates been trending lower but the reduction of rates in response to the Covid lockdowns was unprecedented.

Unfortunately, an extended period of low rates combined with massive government stimulus in response to Covid lockdowns fueled a period of inflation. Central banks failed to anticipate inflation and were forced to rapidly increased rates in 2022 once it took hold. The Bank of Canada raised their target interest rate by 4.0% in 2022 - the largest ever one-year increase. They raised it another 0.75% in 2023.

Being a predictor of the future, the bond market responded to inflation as well and bond yields rose. This pushed fixed mortgage rates higher.

The Bank of Canada made their first cut in four years on June 5, 2024. Bond yields have fluctuated since then, but the 5-year Canada bond yield remains stubbornly above 3%.

Recent Canadian Interest Rate History

Fixed mortgage rates have declined in early 2024 but have flattened out in recent months. The best five-year fixed, insured mortgage rates are now 4.14%.

Variable mortgage rates declined by 1.75% in 2024 due to the rate cuts by the Bank of Canada. Variable rates will only decline further in response to Bank of Canada rate cuts.

As the table below shows, fixed mortgage rates peaked in October 2023 and variable mortgage rates peaked in July 2023. The interest rate environment has improved in the past year or so.

| 5YR Insured | 3YR Insured | 5YR Variable Insured | 5YR Uninsurable | 3YR Uninsurable | 5YR Variable Uninsurable | |

|---|---|---|---|---|---|---|

| 15-Dec-24 | 4.14% | 4.19% | 4.40% | 4.59% | 4.49% | 4.85% |

| 15-Nov-24 | 4.24% | 4.19% | 4.85% | 4.59% | 4.49% | 5.35% |

| 15-Oct-24 | 4.24% | 4.44% | 5.35% | 4.64% | 4.54% | 5.85% |

| 15-Sep-24 | 4.19% | 4.44% | 5.30% | 4.79% | 4.99% | 5.85% |

| 15-Aug-24 | 4.44% | 4.59% | 5.55% | 4.99% | 5.22% | 5.99% |

| 15-Jul-24 | 4.64% | 4.89% | 5.80% | 5.14% | 5.29% | 6.24% |

| 15-Jun-24 | 4.69% | 4.99% | 5.85% | 5.29% | 5.29% | 6.24% |

| 15-May-24 | 4.74% | 4.99% | 6.10% | 5.29% | 5.29% | 6.49% |

| 15-Apr-24 | 4.84% | 4.99% | 6.10% | 5.19% | 5.24% | 6.70% |

| 15-Mar-24 | 4.75% | 5.09% | 6.05% | 5.19% | 5.24% | 6.70% |

| 15-Feb-24 | 4.94% | 5.14% | 6.05% | 5.34% | 5.70% | 6.70% |

| 15-Jan-24 | 4.84% | 5.19% | 6.05% | 5.34% | 5.90% | 6.80% |

| 15-Dec-23 | 4.99% | 5.49% | 6.10% | 5.89% | 6.09% | 6.80% |

| 15-Nov-23 | 5.45% | 5.89% | 6.10% | 6.24% | 6.64% | 6.85% |

| 15-Oct-23 | 5.69% | 6.04% | 6.10% | 6.44% | 6.74% | 6.90% |

| 15-Sep-23 | 5.39% | 5.84% | 6.10% | 6.14% | 6.54% | 6.90% |

| 15-Aug-23 | 5.24% | 5.84% | 6.10% | 6.09% | 6.34% | 6.80% |

| 15-Jul-23 | 5.04% | 5.84% | 6.10% | 5.69% | 6.01% | 6.60% |

| 15-Jun-23 | 4.84% | 5.29% | 5.85% | 5.44% | 5.54% | 6.40% |

| 15-May-23 | 4.49% | 4.89% | 5.55% | 5.04% | 5.34% | 6.15% |

Will Mortgage Rates Continue to Decline in Canada in 2025?

There are many pundits and bank analysts that are paid to make predictions. It is a difficult game, and they are wrong more often than they are right. Just look at recent year’s forecasts to see how wrong they were in 2023, 2022 and 2021. Nevertheless, their predictions are often viewed by market participants as a guide.

As we begin 2025 the banks are predicting more Bank of Canada cuts, but there is no consensus on how much. Four banks expect cuts of about 1% in 2025 (CIBC, NB, RBC and TD). One predicts cuts of 0.75% (BMO) and one only 0.25% (BNS).

The banks are also predicting some declines in bond yields in 2025. The bond market is currently indicating they may be wrong (yields have increased in early Jan) but if they are correct, we could see bond yields decline by 0.25% to 0.50% in 2025. Note, however, that Scotiabank predicts that bond yields will increase about 0.50%.

If the majority view is accurate then borrowers can expect lower mortgage rates in 2025 but not by significant amounts. Having said that a 0.50% decline in mortgage rates would be welcome news. Having variable rates drop below fixed rates will also be a welcome change and any improvement in housing affordability from lower rates will lead to increased market activity.

A return to the abnormally low rates we experienced in recent years is not likely. Absent any sudden economic shock, bond yields will tend to range between 2% and 4% over time. The five-year Canada bond yield today (January 10, 2024) is 3.17%. We are currently in a relatively normal interest rate environment.

Could Mortgage Rates Increase in Canada in 2025?

If the bank analyst’s views on interest rates are accurate then an increase in mortgage rates is unlikely, although some minor movement up and down is possible with fixed mortgage rates. The main risks to these forecasts are i) the possibility that the inflation story is not yet over, and ii) economic strength in early 2025 will push up bond yields and pause central bank interest rate cuts. There are some political and economic concerns that core inflation remains stubborn, oil and gas prices could move higher, the US economy remains strong and then there is the tariff question – they are inflationary and would put a clamp on growth in Canada. It is hard to predict how that would impact rates.

How Can You Stay Informed About Interest Rates?

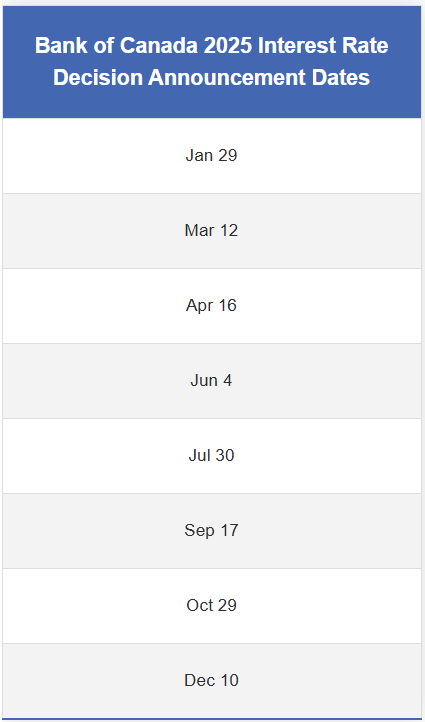

The Bank of Canada interest rate announcements are news to keep an eye on. They make these announcements on preset dates. The schedule for 2025 is:

If you would like to keep track of the five-year government of Canada bond you can track it for free on the internet. There are many websites that let you do this, and an online search will help you find one. Here is a link to one such site - Marketwatch.com/investing/bond/5yr

For current mortgage rates you can go to www.frankmortgage.com to see our mortgage rates that are updated daily.

You can also sign up for our monthly mortgage market update email. It provides a summary of monthly activity in the mortgage and housing markets, including an update on interest rates. You can sign up here.

Mortgage Advice for 2025

Mortgage borrowers today are facing a much better environment that the past couple years. However, uncertainty prevails, and predictions are difficult. The fact is mortgage rates are down. With lower rates and softening house prices, hosing affordability has improved. We talk to many customers that are stressed about their mortgage renewal at higher rates or are bogged down in the math. Things are not as complicated as they seem, especially if you acknowledge how much things have improved since 2022.

Rates may continue to decline in 2025 but waiting for this to happen can lead to frustration. Find out what you can afford at current rates and act on it. If rates decline a bit in 2025, you will likely benefit by the time you actually close a new mortgage.

Variable-rate mortgages are not for everyone. As many have painfully learned over the past few years they come with risk. The risk of higher rates over the next few years exists, so only consider variable rates if you can afford to bear that risk.

Fixed rates are settling into a range. Yes, they may decline but that is only likely in response to economic weakness. We have to be careful what we wish for. The past year has seen many borrowers go for shorter terms but as we near the end of the rate cutting cycle it might be time to consider taking the longest term you can afford.

We are optimistic for a more active housing market in 2025, but challenges persist. Urban condominium markets may struggle in 2025. Detached housing looks to be in better health. Supply has increased in many markets and homebuyers that have their mortgage financing figured out stand to benefit.

We expect most customers to continue to favor fixed rates due to an aversion to interest rate risk and the predictability of fixed payments. Variable-rate mortgage activity is increasing but only for those comfortable with the risk.

We also caution all customers to take interest rate predictions with a grain of salt. The bank analysts that make market predictions like those noted above were correct about rate cuts in 2024 but got it wrong in 2023, 2022 and 2021. What are the odds they get it right this year? Do your own research and seek out opposing views to get the whole picture to inform your own opinions and decisions.

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts