Monthly Market Update - January 15, 2025

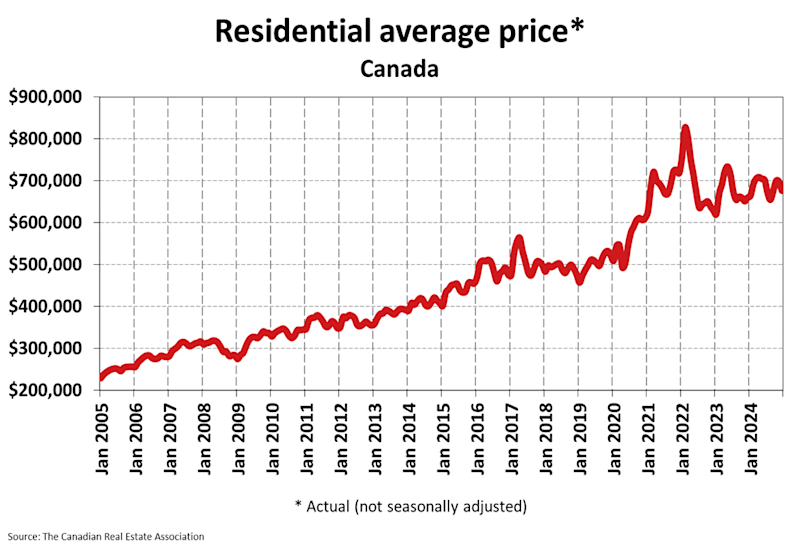

As we enter 2025 and reflect back on a challenging 2024, we can't help but acknowledge that, as this year begins, the market is in a better place than it was one year ago. Mortgage rates are lower. Home prices in many markets are down. Affordability is still stretched for many, but at least it is a bit better.

There are still many challenges - urban condo may be in for a rough year, as an example - and market, rate and political risks remain. But, let's take the gains we have seen recently as a positive and hope we can build on that.

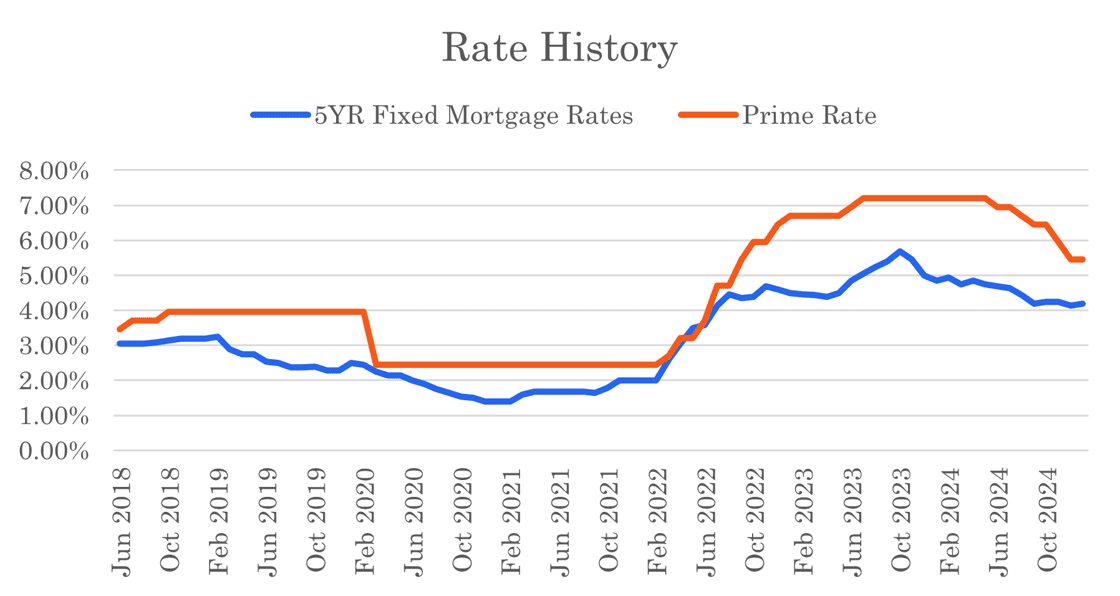

The Bank of Canada cut rates by 1.75% in 2024. Expectations for rate cuts in 2025 are much more muted. The average analyst prediction is for cuts of between 0.50% and 0.75% during the year. This will lead to a further reduction in variable mortgage rates and finally return variable rates below fixed rates where they normally reside. The Bank of Canada's next interest rate announcement is on Jan 29. We think that the Bank of Canada will be limited in its ability to cut rates if the US Federal Reserve is not also cutting rates. Further Canadian rate cuts will weaken our dollar and the Bank is usually reluctant to push that too far.

Five-year bond yields have increased in the first half of January and are 0.19% higher than this time last month. Interestingly, the five year bond yield today is only 0.10% lower than it was at the start of 2024. It feels like all interest rates declined during 2024 but the Canadian five year bond yield is relatively flat year-over-year. Despite this, fixed mortgage rates declined in 2024 as lenders became more aggressive competing for business and accepted less margin. With bond yields not declining materially, and actually rising in the US, we are not expecting any fixed mortgage rate relief in the near future.

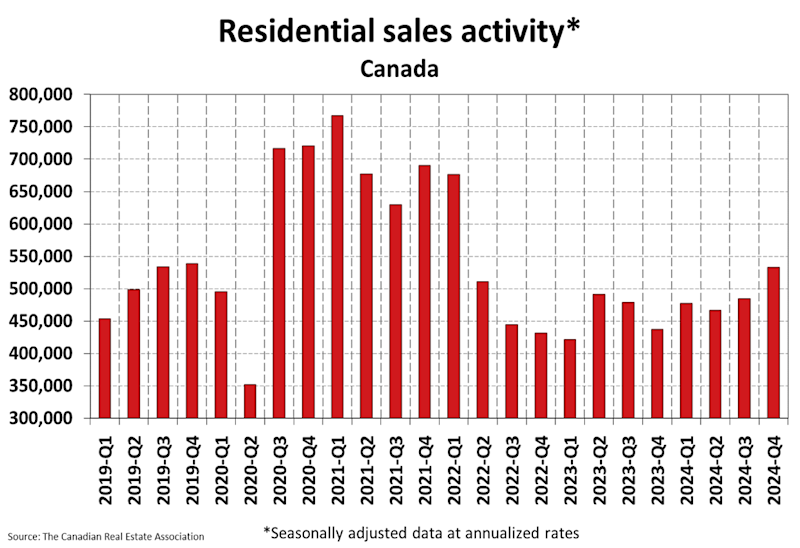

Housing sales increased in the fall but declined in December. Many buyers remain sidelined, waiting for better prices or lower rates. Expectations for a market rebound have moderated, but activity may return to more healthy levels as the market adjusts. Even the most bullish forecasts for house prices in 2025 are relatively tame.

Our best national insured, five-year fixed mortgage rate is now 4.19% and best insured, three-year fixed mortgage rate is also 4.19%.

Variable rates remain higher than fixed rates but the gap is closing. Our best national insured, five-year, variable mortgage rate is 4.40%. Variable rates will only decline further in response to additional rate cuts by the Bank of Canada.

Mortgage Market

- The prime rate is 5.45%

- Bond yields are have increased in the past month. US bond yields have risen and Canadian yields have responded. The bond market is not signaling that lower rates are coming any time soon.

- The five year government bond yield is 3.18% today, up from 2.99% last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Variable mortgage rates are unchanged in the past month

- Fixed mortgage rates are fairly flat but there is upward pressure due to increasing bond yields

- Short-term fixed mortgage rates (1 & 2-year rates) remain higher than 5-year mortgage rates. The yield curve is flattening, however, and now 3-year mortgage rates are comparable to 5-year rates.

- Canada’s Big 6 banks are split on Bank of Canada rate cuts for Q1 2025. BMO, Scotiabank and TD expect one 25-bps cut, while RBC, CIBC and NB foresee 50bps of cuts - Canadian Mortgage Trends

- January Bank of Canada rate cut in doubt after strong December jobs report - Global News

- The market-implied probability of a rate hike in the US over the next year has risen sharply since the November elections - Goldman Sachs

- The Fed will take a more cautious approach to policy easing, cementing expectations of a rate pause in January - BMO

- Strong job growth in December raises doubts about January rate cuts - Canadian Mortgage Trends

- The heads of Canada’s top banks expect many mortgage holders to be able to renew at lower rates over the next two years as the lenders compete for a larger share of the market - Financial Post

- 60% of Canadian mortgage renewals to face higher rates by 2026 - BoC

- Don't be fooled, Canada's new mortgage rules are a recipe for more consumer debt - Globe & Mail

- Bank CEOs see mortgage risk easing - Global News

- Canada stuck in recession if you look past the headline numbers - Financial Post

- More than one million Canadian mortgages are up for renewal in 2025 - CTV News

- 7 in 10 mortgage holders anxious about upcoming renewals - Mortgage Professionals Canada

- BMO reinstates stress test for uninsured mortgage switches

- National Bank's acquisition of Canadian Western Bank receives final approval - Financial Post

- Canadian seniors more likely to have a mortgage than young adults - Better Dwelling

- Inflation in Canada was 1.9% in Nov. Data for Dec will be released on Jan 21.

Housing Market

The MLS Home Price Index (HPI) was up 0.3% month-over-month in December 2024. The actual (not seasonally adjusted) national average sale price was up 2.5% year-over-year. The actual national average home price was $676,640 at the end of December 2024.

Housing Sales fell by 5.8% month-over-month in December 2024. Actual (not seasonally adjusted) sales were up 19.2% over the prior year, December 2023.

Housing Market Headlines

- New listing activity in December declined 1.7% month-over-month - CREA

- Nationally, there were 3.9 months of housing inventory for sale at the end of December 2024. The long-term average is closer to 5 months - CREA

- With much of the early fall surge of supply having now been picked over, home sales activity dipped in December 2024 - CREA

- Sales were down 5.8% compared to November, but still stand 13% above where they were in May, just before the first interest rate cut by the Bank of Canada in early June - CREA

- The Canadian housing market should firm modestly this year, but it’s still a long way back to the 2022 highs - BMO

- After several years of unusual volatility in the real estate market, key indicators point to a return to stability in 2025 - Royal LePage

- Expect a more active market next year, with the national average residential price likely to increase by five per cent, and sales anticipated to rise in 33 out of 37 regions surveyed, with sales increases of up to 25% - RE/MAX

- Early indicators suggest that 2025 could see heightened activity in the spring, driven by continued rate cuts and a stabilized economic outlook. While prices are expected to rise moderately, the market remains poised for balanced growth, with conditions favouring both buyers and sellers - Royal LePage

- Gradually falling borrowing costs and continued economic growth should support positive sales growth in 2025. Mortgage rule changes implemented in December will also boost demand and prices - TD

- BC's real estate market in 2025 will be more 'balanced' - City News

- Vancouver home sales rose 31% in December - Baystreet

- Edmonton real estate heating up for 2025 - CTV News

- Calgary home sales down in December from prior year's levels but remained nearly 20% higher than long-term trends - CREB

- 'Seller's market': Winnipeg home prices, number of sales jump in 2024 - Winnipeg Free Press

- Toronto home sales down in Dec by 1.8% compared to Dec 2024 - TREB

- Mississauga home sales decline 35% in Dec - Insauga

- Ottawa home sales increase 8% at the end of 2024 - CTV News

- Home affordability improves, but still challenging for many Canadians - RBC

- A maximum 20-per-cent home-flipping tax is among new regulations taking effect in British Columbia as of Jan 1

- Alberta leads Canada in housing starts per capita - City News

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.