Monthly Market Update - November 15, 2024

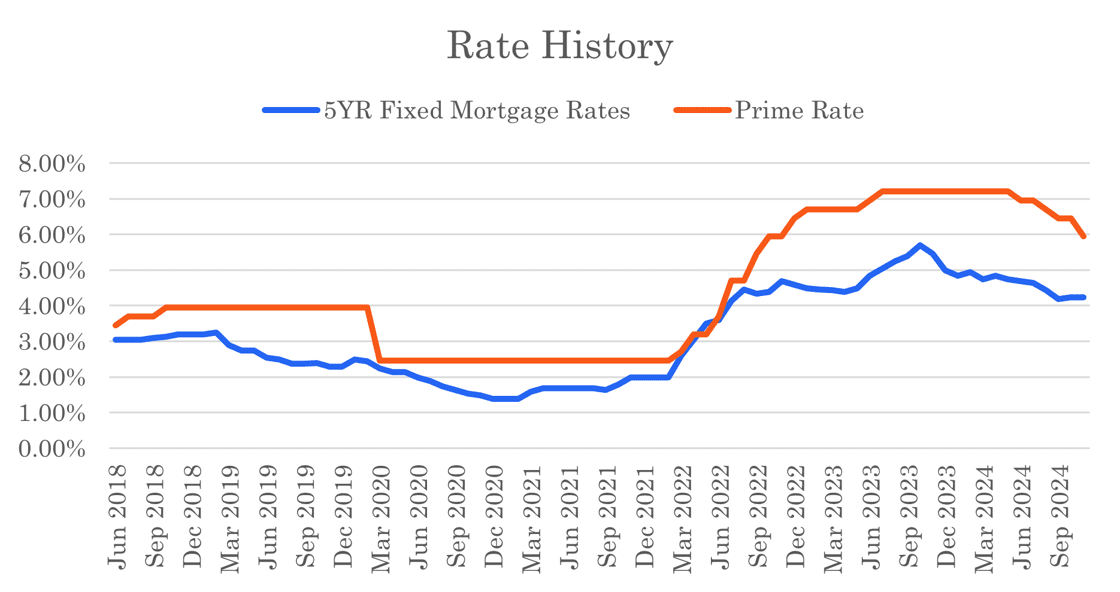

The Bank of Canada made a 'super-sized' rate cut of 0.50% on October 23. This is the largest rate cut since the pandemic and is welcome news for mortgage borrowers. In response, the prime rate dropped to 5.95%, meaning that the best five-year variable mortgage rates are now below 5%. Five-year fixed mortgage rates did not change, demonstrating how Bank of Canada cuts do not have the same impact on fixed mortgage rates.

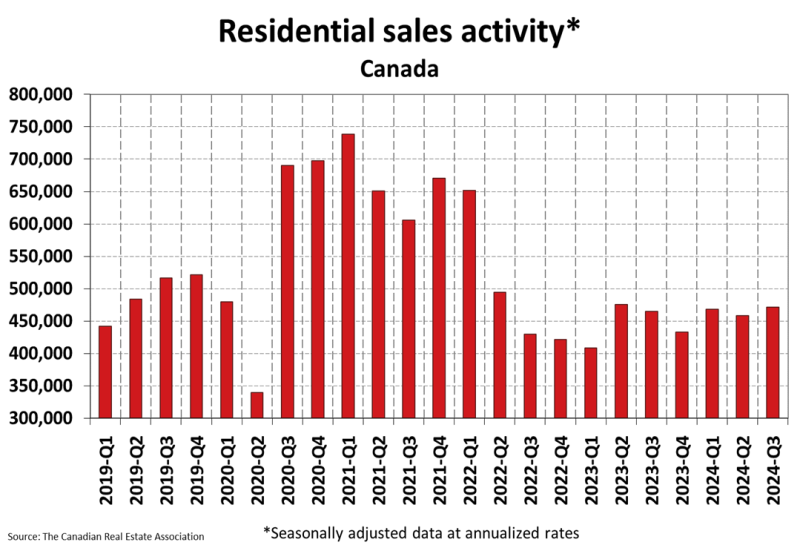

Housing sales increased in October, surprising many. Sales were up by double digits in some markets, including Vancouver and Toronto. Recent increases in supply contributed to this activity together with the recent reductions in rates. Many prospective buyers remain on the sidelines, waiting for additional rate reductions. If supply continues to grow and rates drop further there is potential for an increase in market activity in early 2025.

The rate cutting cycle continues, now with four consecutive cuts and more expected. The Bank of Canada will make an interest rate announcement on December 11. The market expects another rate cut, but is split whether it will be a 0.25% or 0.50%.

Five-year bond yields increased in the past month and are now higher by close to 0.50% in the past two months. Sentiment is growing that fixed mortgage rates are near bottom. If this is true, then fixed mortgage rates may move around within a range from the high 3% to mid 4% range for the foreseeable future. While they may decline a bit from today's rates, if you are waiting for fixed rates to drop significantly before entering the market, you may be disappointed.

Our best insured, five-year, fixed mortgage rate is now 4.24% and best three-year, fixed rate mortgage rate is 4.19%.

Variable rates remain higher than fixed rates but the gap is closing. Variable rates dropped by 0.50% after the Oct 23rd Bank of Canada rate cut. This moved our best insured, five-year, variable mortgage rate down to 4.85%. Variable rates will only decline further in response to additional rate cuts by the Bank of Canada.

Mortgage Market

- The prime rate is 5.95%

- Bond yields increased in October and again in early November. There is some pressure for lenders to increase mortgage rates but they have been holding steady. Recent changes in the best fixed rates are mainly due to competitive dynamics.

- The five year government bond yield is 3.11% today, up from 2.92% last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Variable mortgage rates declined by 0.50% in the past month

- Fixed mortgage rates remain lower than variable mortgage rates but the gap is now less than 1%

- Short-term fixed mortgage rates (1 & 2-year rates) remain higher than 5-year mortgage rates, but 3-year mortgage rates are now comparable to 5-year rates.

- Fixed mortgage rates are influenced by bond yields, and Canadians shouldn't count on those yields dropping much further - TD

- The latest big bank rate forecasts - how much lower will Bank of Canada rates drop by the end of 2025? Note - these rates affect variable rates much more than fixed rates.

- RBC - 1.75%

- NB - 1.75%

- CIBC - 1.50%

- BMO - 1.25%

- TD - 1.25%

- BNS - 0.75%

- Interest rates have further to fall, but fixed mortgage rates are already nearing their bottom - Globe & Mail

- A weakening job market is a bigger threat to the mortgage market than the coming wave of mortgages renewing into higher rates - RBC

- Mortgages with terms of 3 or more years but less than 5 years are the most popular - CMHC

- The "mortgage renewal wall" over the next two years will act as a “modest headwind” rather than a major disruption for most Canadian homeowners. Many homeowners who locked in low rates in 2021 or 2022 were stress-tested at higher levels, typically around 5.25%, meaning they proved their ability to pay higher rates if necessary - BMO

- Federal Government changes mortgage insurance rules to encourage more construction of secondary suites and new units to existing homes. A 90% LTV and 30-year am will be permitted for insured mortgages when adding up to a maximum of three additional units for properties valued less than $2 million.

- Mortgage arrears in Toronto and Vancouver to rise to highest levels in 10 years - CMHC

- Relaxed mortgage rules will cost homebuyers in the long run, BoC senior deputy warns - Globe & Mail

- National rent prices declined year-over-year for the first time in over three years - Rentals.ca and Urbanation

- We are in no rush to cut rates - US Federal Reserve

- Inflation in Canada is decelerating a bit more rapidly than expected - Scotiabank

- Inflation in Canada declined to 1.6% in Sept. Oct data will be released on Nov 19.

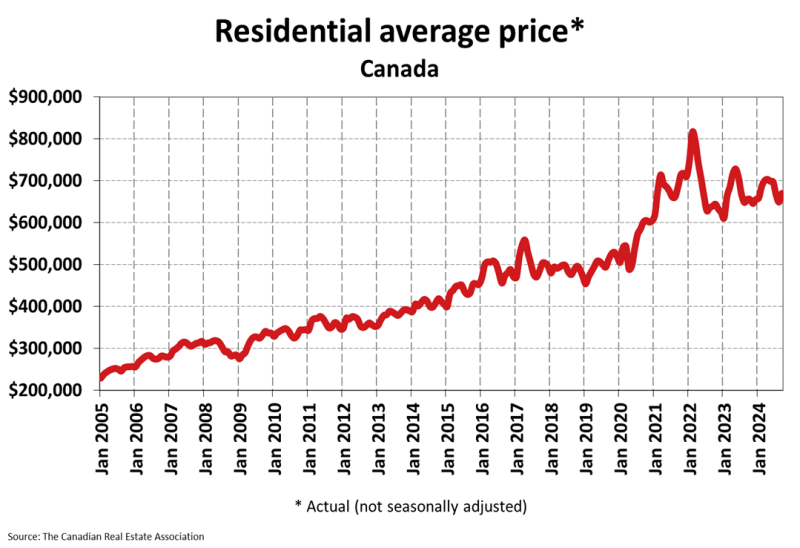

Housing Market

The MLS Home Price Index (HPI) declined slightly by 0.1% month-over-month in October 2024. The actual (not seasonally adjusted) national average sale price was up 2.7% year-over-year. The actual national average home price was $696,166 at the end of October 2024.

Housing Sales increased by 7.7% month-over-month in October 2024. Actual (not seasonally adjusted) sales were up 30% over the prior year, October 2023.

Housing Market Headlines

- New listing activity in October declined 3.5% month-over-month - CREA

- Nationally, there were 3.7 months of housing inventory for sale at the end of October 2024. The long-term average is closer to 5 months - CREA

- Canadian home sales see a surprise jump in October - CREA

- You can think of the October numbers as a sort of preview for what we might expect to see next year - CREA

- Real estate developers predict mortgage changes will do little to spur demand for newly built homes - Globe & Mail

- While we are still early in the Bank of Canada’s rate-cutting cycle, it definitely does appear that an increasing number of buyers moved off the sidelines and back into the marketplace in October - TREB

- Canada's 'sluggish' housing market could be recovering - Global News

- Canada's condo supply is soaring - RE/MAX

- Recent mortgage reforms introduced by the federal government, while a step in the right direction, aren’t enough to fully address Canada’s growing housing affordability crisis - MPC

- We need to resist the temptation to try to solve the housing affordability challenge by tinkering too much with the mortgage market. Improving housing affordability ultimately requires reaching a balance between supply and demand, which will take time - BoC

- Housing market activity will increase in 2025, buoyed by rate cuts and proposed federal changes to expand access to insured mortgages and 30-year amortization options - CMHC

- A majority (58%) of Canadians aged 18 to 43 are still determined to purchase a home within the next five years - Scotiabank

- Toronto condo sales drop 4.4% in Q3 while rental listings rose - TREB

- Positive movement in Ottawa's real estate market in October with home sales up nearly 50% - CTV News

- Vancouver home sales jump in October amid lower borrowing costs - Real Estate Magazine

- Manitoba real estate sales pick up steam in October - CTV News

- While it's promising that a segment of Canadians are poised to act on upcoming rate drops, the reality is that over two-thirds are still waiting on the sidelines - EveryRate.ca

- Federal Conservatives propose to abolish federal sales tax on new homes under $1 million - CBC

- 4 in 5 Canadians say housing crisis is shaping life decisions - Real Estate Magazine

- Around 3.5 million additional units are required by 2030 to restore affordability in the housing market, but the current pace of homebuilding – 223,808 units on a seasonally adjusted yearly basis means that remains a distant prospect - CMHC

- Housing starts were up 5% in September - CMHC

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.