Prime Rate Canada

Why Does it Matter to Mortgage Borrowers?

Canadian mortgage borrowers have experienced stress in recent years due to changing interest rates. News headlines commonly refer to the Bank of Canada interest rate changes and the prime rate, noting the frequent changes in the these rates and the impact they have on variable-rate mortgage borrowers. Recently, the prime rate has been declining but it appears to have leveled off. This rate stability is good news but, as a mortgage borrower, do you understand how the prime rate affects you?

4.45%

Current Prime Rate

What is the prime rate?

The prime rate is most commonly defined as the interest rate commercial banks charge their most credit-worthy customers. It serves as a benchmark rate for setting the rates on a variety of financial products, including mortgages, personal loans, and lines of credit. The prime rate is influenced by several factors, including inflation, economic growth, and the supply and demand for credit.

The prime rate is determined by the banks themselves, and is typically set at a level that is 1.5 to 2.5 percentage points above the overnight lending rate set by the Bank of Canada. The prime rate has been declining in recent months and is currently (as of December 10, 2025) 4.45%.

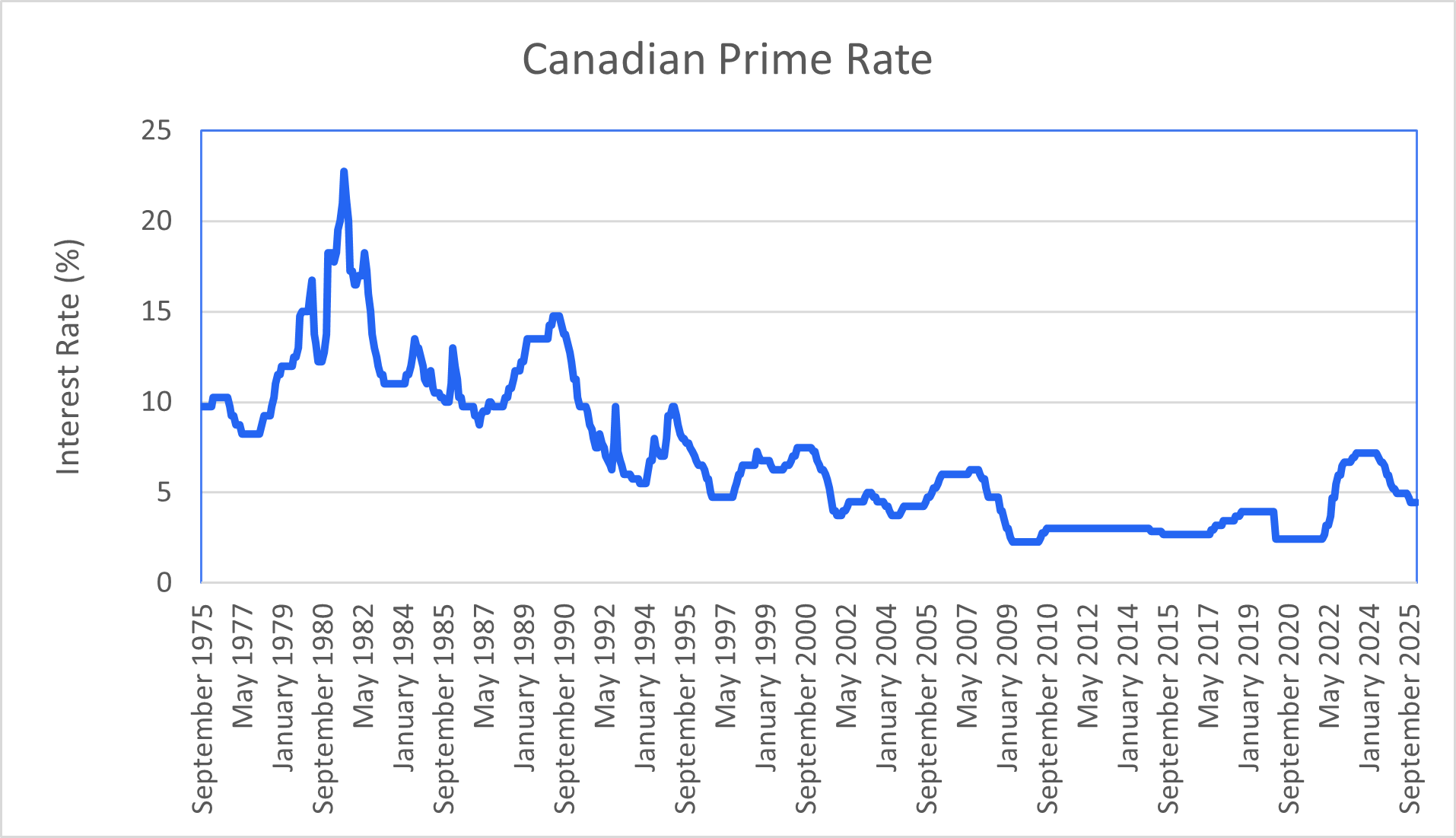

While the current prime rate appears high to us today, that is because it had been unusually low over the past decade. The average Prime Rate over the past 50 years is 7.20%, compared to today’s Prime Rate of 4.45%.

How is the prime rate determined?

Each Canadian bank sets their own prime rate. They generally end up being the same rate, with no difference between the banks. Independent mortgage lenders do not set their own prime rate. They reference one or more of the big banks and use their prime rates as their reference prime rate.

The Bank of Canada's monetary policy is a key determinant of the prime rate even though it does not directly set it. The Bank of Canada uses its benchmark overnight lending rate to regulate the nation's economic growth and restrain inflation. The Bank of Canada influences short-term interest rates by adjusting the target for the overnight rate on eight fixed dates each year.

When the Bank of Canada changes the overnight rate, the Canadian banks usually change their prime rates within a couple days. They tend to move their prime rates by the same amount and in the same direction that the Bank of Canada moves the overnight lending rate.

How do banks use the prime rate?

Banks use the prime rate as a benchmark rate for a variety of financial products, including mortgages, personal loans, and lines of credit. The interest rate charged for these products is typically set at a margin above or below the prime rate. Most products will have a rate of Prime plus a margin but variable rate mortgages for the best borrowers are usually priced at Prime minus a margin. For example, a bank might offer a variable-rate mortgage at a rate of prime minus 0.5% (equal to 3.95% today). As the Prime Rate moves up or down the variable mortgage rate will move also, but the margin stays the same for the term of the mortgage.

How are variable mortgage rates set relative to the prime rate?

Variable mortgage rates are directly tied to the prime rate. When the prime rate goes up, so does the interest rate on a variable rate mortgage. Conversely, when the prime rate goes down, so does the interest rate on a variable rate mortgage. This means that borrowers with variable rate mortgages are exposed to interest rate risk, as their mortgage payments can increase if the prime rate increases.

The margin relative to the prime rate depends on market conditions, the risk profile of the borrower and the costs of lending. When market conditions are positive, the margin for the best borrowers can more than 1.00%. When market conditions are weaker, that margin can be as small as 0.25% to 0.50%.

As an example, using today’s prime rate, the rate on a variable rate mortgage might be 3.95%:

4.45% - 0.50% = 3.95%

If the prime rate was reduced by 0.25% to 4.20%, the rate on a variable-rate mortgage would become:

4.20% - 0.50% = 3.70%

The margin of 0.50% stays the same for the term of the mortgage but the mortgage rate will change when the prime rate changes.

The prime rate is usually the same for all banks. They will use this base prime rate for pricing variable rate mortgages and the competitive difference in rate is the margin below the prime rate that they offer. However, there is one bank that does things differently. TD Bank uses a prime rate for mortgage lending that is equal to their prime rate plus 0.15%. They have been doing this since 2016. Borrowers should note this since TD needs to offer a larger margin discount to their prime rate to get you to the same rate being offered by other lenders.

Want to Find Some Low Mortgage Rates?

Is Today’s Prime Rate Historically High?

The prime rate fluctuates over time. There have been significant increases in the past, primarily due to central bank efforts to tame inflation, very similar to what happened in Canada in 2022. The current prime rate seems very high but is it really that high when compared to the past? The answer is yes, when you compare it to recent history. However, the business and interest rate cycles run over a long time period and when you look back further in history, today’s prime rate looks low.

| Prime Rate | BoC Overnight Rate | Difference | |

|---|---|---|---|

| 50 Year Average | 7.18% | 5.49% | 1.69% |

| 20 Year Average | 3.75% | 1.72% | 2.03% |

| 10 Year Average | 3.61% | 1.43% | 2.18% |

A 4.45% prime rate is higher than recent history but relatively average when looking back over the long-term. Rates have steadily declined over the past 40 years, so it makes sense that recent average rates would be lower. That period of consistent decline appears now to be over.

Note also that the difference between the prime rate and the BoC overnight rate has increased over time. The long-term, 50-year average difference is 1.69%. That difference today is 2.20% (4.45% prime rate versus 2.25% BoC target overnight rate). Banks are now charging more for their prime rate than they did in the past.

What is the historic margin between variable mortgage rates and the Prime Rate?

The historic margin between variable mortgage rates and the prime rate has varied over time. In general, the margin tends to be a discount ranging between 0.5% and 1.5%, depending on market conditions and the risk profile of the borrower. During times of economic uncertainty or when credit conditions are tight, banks may offer less of a discount margin to account for increased risk.

Can anyone predict where the prime rate will go in the future?

Predicting where the prime rate will go in the future is difficult. It is influenced by a wide range of factors and, as we saw in 2022, can be subject to sudden changes. Some economists and analysts use models to forecast the future direction of interest rates, but these projections are often imprecise and subject to error. Ultimately, the direction of the prime rate will depend on a variety of economic factors that influence the rate setting policy of the Bank of Canada, including inflation, economic growth, and the supply and demand for credit.

Trying to predict the future direction of interest rates can be a risky exercise for a mortgage borrower. Just look at what happened to variable-rate mortgage holders in 2022. Many took out variable rate mortgages when rates were very low and subsequently experienced financial stress due to higher rates. A fixed-rate mortgage would have been a better decision. Looking at a variable-rate mortgage as an opportunity to benefit from rates declining without considering the risk if rates were to increase isn't a complete analysis. The best analysis for most of us is to find the rate that we can afford that we can lock-in for as long as possible. Making a bet on Interest rates is arguably inappropriate for a homeowner that is trying to secure financing for their house. It is a material risk. Assess your risk tolerance and understand what happens if your bet on rates does not work out. Taking interest rate risk is only appropriate for the minority of us that can afford to be wrong.

Most Recent Bank of Canada Rate News

The Bank of Canada kicks off 2026 by holding rates steady, announcing on January 28 that its overnight policy rate will remain unchanged at 2.25%. This is the second straight announcement with no change, indicating that rates may have leveled off for the time being. Economists are forecasting this stability to continue for the foreseeable future, providing a much needed breather in the mortgage market.

The Bank of Canada stated that "Monetary policy is focused on keeping inflation close to the 2% target while helping the economy through this period of structural adjustment. Governing Council judges the current policy rate remains appropriate, conditional on the economy evolving broadly in line with the outlook we published today."

We start off the year with the Bank of Canada Policy Rate 1.0% lower than it was at the start of 2025. The housing affordability math is better today, but still strained for some potential homebuyers. There is no consensus on longer term expectations though, as some analysts expect that the policy rate could be higher by the end of the year. Time will tell, forecasts that far out in the future are hard to rely on.

The prime rate at the major banks and variable mortgage and HELOC rates with all lenders should remain unchanged. Bond yields have held steady and are only 0.07% lower than they were on the date of the last Bank of Canada rate announcement on Dec 10. Despite that bond rate stability some mortgage lenders have lowered fixed mortgage rates to win more business. Most variable mortgage rates remain lower than fixed mortgage rates for the equivalent term.

While lower rates are hoped for by many, they are not to be expected. However, this rate stability is good news for mortgage borrowers. Why?

Predictability: Stable rates mean you can plan your finances with confidence, without worrying about sudden hikes or missing out on sudden drops.

Affordability: Rates are now in a normal range and consistent borrowing costs make it easier to budget for your dream home or refinance.

Opportunity: If you are on the fence about locking in a rate, now is a prime time to explore options and understand the math before any potential shifts.

Looking forward, expectations for cuts are low and economists expect the Bank to remain on hold through 2026. The Bank's neutral range, where the overnight rate neither stimulates nor restricts the economy, is 2.25% to 3.25%. With the current policy rate sitting at the lower end of that range (2.25%), the Bank is likely to be cautious about additional cuts unless we see significantly weaker economic data. No such signs exist today and the Bank stated "it is too early to tell how the Canadian economy will adjust to current tariffs and ongoing uncertainty."

The housing market in some major centres is now a buyer's market and those that can afford to buy in this environment can take advantage. If you are waiting for rates to drop further you may be disappointed. Start your search for a new home by getting a mortgage pre-approval to lock-in a rate and protect yourself. Current mortgage holders should run the numbers and see if refinancing at lower rates make sense. Whatever your situation, talk to us at Frank Mortgage to discover your best options.

The prime rate at the banks remains at 4.45%.

You can read the Bank of Canada's full press release here -

https://www.bankofcanada.ca/2026/01/fad-press-release-2026-01-28/

The next Bank of Canada rate announcement is scheduled for March 18th.

Final Word

The Canadian bank prime rate plays an important role in the country's financial system, serving as a benchmark rate for a variety of financial products. While the Bank of Canada does not directly set the prime rate, it does have an indirect influence on it through its monetary policy. Banks use the prime rate as a basis for setting interest rates on loans and lines of credit, and borrowers with these variable-rate products, such as variable-rate mortgages, are exposed to interest rate risk. While predicting the future direction of the prime rate is difficult, understanding how it is determined and how it is used by banks and borrowers can help individuals make informed financial decisions.

If you have a variable rate mortgage you need to be aware that rates may unexpectedly increase. The market now believes that the rate cutting cycle has ended and the Bank of Canada will not be cutting rates again in the near future. While this is the expectation today, the current geo-political environment is uncertain and the risks are high. Manage your own affairs without trying to guess where rates are going. Variable-rate mortgages contain risk and are not for everyone.

If you are in the market currently for a mortgage, a fixed rate might be the best solution. With no exposure to interest rate risk during the term of the mortgage, a fixed-rate mortgage is the conservative choice for the majority of us that have a low risk tolerance.

Let Frank Mortgage Help Find Your Best Mortgage Deal

(Click here to Register and Take Advantage of our proprietary mortgage system)

Prime Rate FAQs

The Bank of Canada is Canada’s central bank. The main function of a central bank is to promote the economic and financial welfare of Canada by overseeing monetary policy, influencing interest rates, issuing bank notes, and supervising Canada's financial institutions.

Established in 1934, the Bank of Canada operates as a Crown corporation under the Bank of Canada Act. As part of its operational role, the Bank of Canada is responsible for setting the target for the overnight interest rate. This is the rate at which major financial institutions lend and borrow money from each other on an overnight basis. The overnight rate affects the rates that the banks offer of credit products. As a result, it influences the cost of borrowing for consumers and businesses and, therefore, the overall level of economic activity in the country.

The Bank of Canada also plays a critical role in managing Canada's foreign reserves and providing financial services to the Canadian government. The Governor of the Bank of Canada is appointed by the government, reporting directly to the Minister of Finance.

Canadian banks change their prime rate is response to changes in the overnight rate that is set by the Bank of Canada. Banks set the prime rate at a margin above the overnight rate. As a result, when the overnight rate moves up or down, the prime rate will also move up or down.

The Bank of Canada sets the target for the overnight interest rate eight times a year, in a series of announcements known as "Monetary Policy Reports" or "Interest Rate Decisions." These announcements are scheduled at the beginning of each year and are made by the Bank's Governing Council. In rare instances the Bank of Canada may also hold emergency meetings where changes to the overnight rate can be announced. The last time this happened was early in the covid pandemic.

| Bank of Canada 2026 Interest Rate Decision Announcement Dates |

|---|

| Jan 28 |

| Mar 18 |

| Apr 29 |

| Jun 10 |

| Jul 15 |

| Sep 2 |

| Oct 28 |

| Dec 9 |

There are no guarantees when it comes to interest rates, but the reason for the dramatic increase in the prime rate in 2022 was the dramatic increase in inflation. It is the widely held expectation in the market that once inflation is reduced to a level closer to the Bank of Canada’s 2% target level that the overnight rate would be reduced. If this were to occur, it would lead to a lower prime rate as well.