Monthly Market Update - November 15, 2023

Have Mortgage Rates Peaked?

Both housing sales and prices declined in many markets on October, but could the recent decline in fixed mortgage rates offer a reprieve?

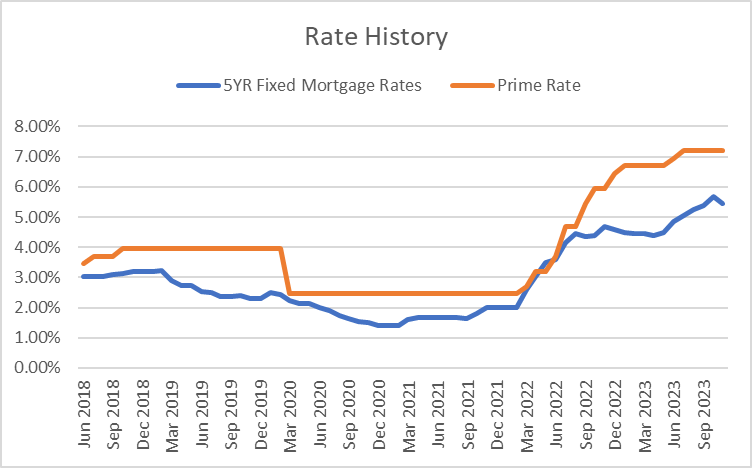

The Bank of Canada held rates unchanged at their scheduled announcement on October 25, but they remain concerned about inflationary pressures and left the door open to further increases. Their next rate announcement is scheduled for December 6.

Bond yields declined by 56 basis points (0.56%) since their peak in early October. Fixed mortgage rates have declined in response but not by the same amount. Non-bank mortgage lenders have lowered their rates more rapidly than the big banks.

Housing sales volume declined in most markets. Likewise, mortgage volumes have also declined. House prices have softened. Inventory for sale has increased as many buyers wait on the sidelines. Housing affordability remains a challenge.

Mortgage Market

- The prime rate remains at 7.20%

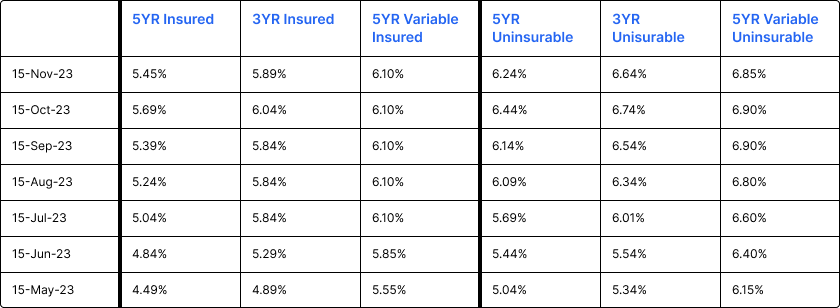

- Fixed mortgage rates declined this past month, as shown below:

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Fixed mortgage rates at most lenders have declined in response to the decline in fixed bond yields in the past month

- Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- Expected wave of mortgage renewals contributed to rate hold decision - Bank of Canada

- We are very, very close to the end of monetary tightening - CIBC

- Bank of Canada says households and businesses in Canada should ready themselves for an era of borrowing costs higher than those seen over the past 15 years - BNN Bloomberg

- OSFI confirms that existing mortgage borrowers can switch to a new lender at renewal without requalifying under the mortgage stress test.

- About 45% of all outstanding mortgages across Canada (2.2 million in total) are expected to face "interest rate shock" from higher interest rates upon renewal in 2024 and 2025 - CMHC

- Mortgage rates will start dropping sooner than expected - Toronto Star

- Majority of borrowers concerned about mortgage renewals - Royal LePage

- OSFI not moving forward with their proposed tighter underwriting guidelines

- Equitable Bank announces a new 40-year amortization mortgage product in Ontario, BC and Alberta. It is priced like a B-product.

- Bringing down inflation is proving more difficult than we thought - Bank of Canada

- Government spending plans are at odds with the Bank of Canada's plans on slowing inflation - Bank of Canada

- Fixed-payment variable-rate mortgages are a "dangerous product" - OSFI

- Customer satisfaction for Canada’s five largest banks has significantly decreased - JD Power

- Inflation in Canada declined to 3.8% in September, down from 4% in August. October inflation data will be released on November 21.

Housing Market

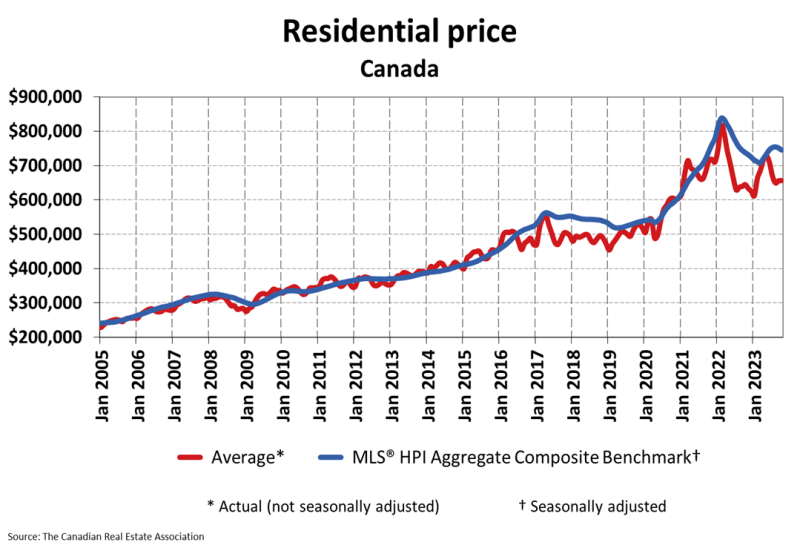

The MLS Home Price Index (HPI) was down 0.8% month-over-month in October 2023. The actual (not seasonally adjusted) national average sale price was up 1.8% year-over-year.

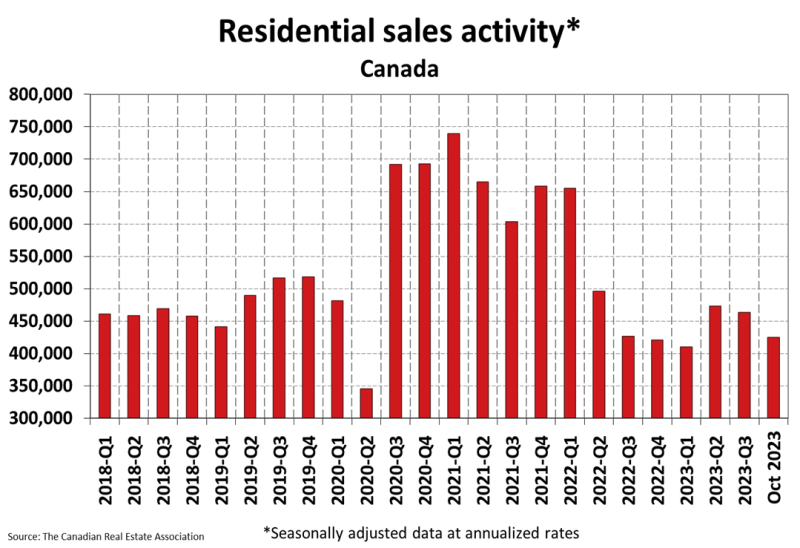

Housing Sales were down 5.6% month-over-month in October 2023. Actual (not seasonally adjusted) sales were up by 0.9% over the prior year, October 2022.

Housing Market Headlines

- New listing activity in October declined 2.3% month-over-month - CREA

- "Nationally, there were 4.1 months of housing inventory for sale at the end of October 2023. The long-term average is about five months." - CREA

- Royal LePage downgrades Q4 home price forecast.

- October sales data reveal that "some sellers are shelving their plans until next spring" - CREA

- Canada home prices slide as homebuyers go into 'hibernation' - Financial Post

- Buyers take 'upper hand' in some of Canada's most expensive housing markets - Global News

- Rental prices surge to records highs in October - CTV News

- Lenders foreclose on Canada's tallest residential real estate project after $1.35B default - Better Dwelling

- Housing affordability saw a considerable deterioration in Q3 2023 - National Bank

- Cooling housing market could spur Bank of Canada to cut rates sooner - Capital Economics

- Interest rates will be the main factor driving the trends in house prices - Realosophy Realty

Do you have questions about a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.