Monthly Market Update - March 17, 2025

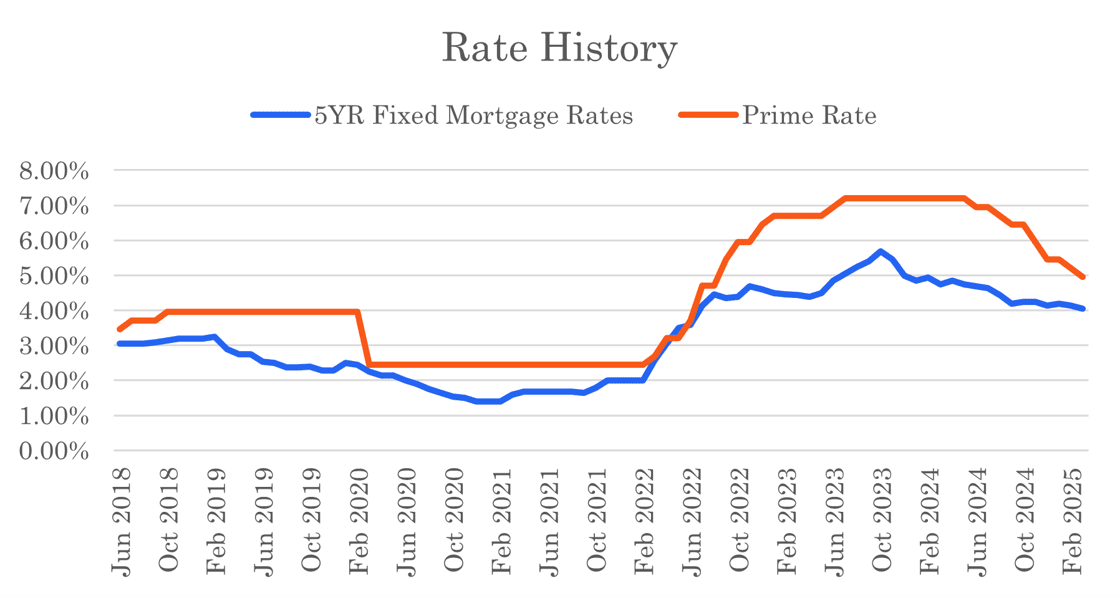

Another rate cut arrived on March 12 in the midst of great uncertainty. The tariff discussion dominates the news and the US appears determined to make some significant changes to international trade relations. As we brace for the impact of this, our mortgage and housing markets will be dealing with an improving rate environment and continuing economic uncertainty.

The Bank of Canada cut rates by 0.25% on March 12. The Bank is attempting to offset the negative economic impacts of the tariff fracas but even they admit that "monetary policy cannot offset the impacts of a trade war".

In times of uncertainty it is best to prepare for the unexpected. While the market expects rates to decline we are already seeing bond yields tick up slightly. This may not make intuitive sense but note that if the bond market believes that central bank rate setting could unleash inflation again, bond yields will rise. The central banks have a delicate balancing act to conduct in the coming months. We believe we will see more borrowers looking to lock in a rate long term to reduce worry and avoid the risk. If you are in the market today, it is advisable to lock-in a rate now to protect yourself.

Variable mortgage rates are 0.25% lower, moving in concert with the Bank of Canada rate. Some lenders have reduced fixed rates modestly in the past couple weeks. Bonds yields are flat since the Bank of Canada rate cut so we might not see more fixed mortgage rate declines any time soon.

Our best national insured, five-year fixed mortgage rate is now 4.04% and best insured, three-year fixed mortgage rate is 4.09%. In some Provinces, better rates can be found so reach out to us to find out where the best deals are available.

Variable rates are now comparable to fixed rates. Our best national insured, five-year, variable mortgage rate is 4.05%. Variable rates will only decline further in response to additional rate cuts by the Bank of Canada.

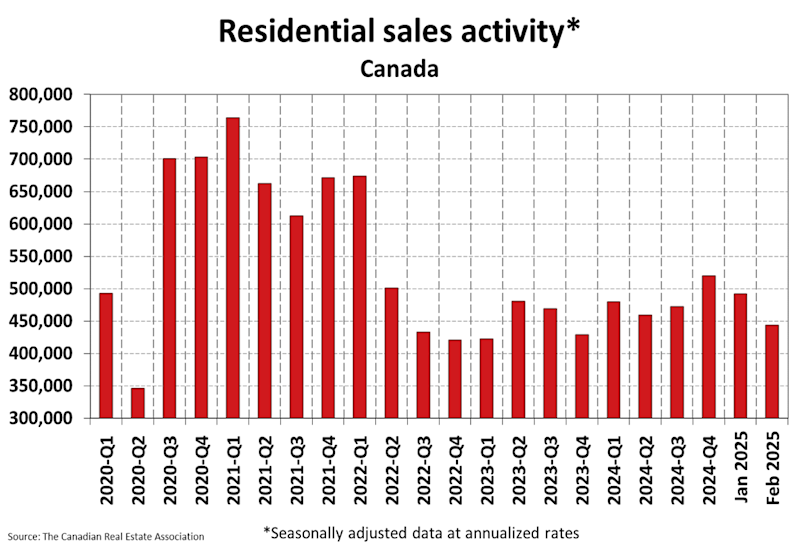

Housing sales were down 9.8% in February. Economic uncertainty is giving market participants reason to pause. Getting to the end game on tariffs quickly might be necessary to clear up the confusion. A Federal election in Canada is also expected. Perhaps some certainty about the direction forward can come from that.

Mortgage Market

- The prime rate is 4.95%

- Bond yields have varied over the past month and are about 0.25% lower than this time last month.

- The five year government bond yield is 2.62% today. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Variable mortgage rates are down after the Bank of Canada rate cut on Mar 12

- Fixed mortgage rates are down as some lenders get more aggressive

- Short-term fixed mortgage rates (1 & 2-year rates) remain higher than 5-year mortgage rates. The yield curve is flattening, however, and now 3-year mortgage rates are comparable to 5-year rates.

- Our economic outlook is consistent with rates coming down across the curve - National Bank

- This rate cut is a band-aid for a wound of unknown size - CIBC

- Bank of Canada likely to cut interest rates at each of its next four announcements in response to tariffs - BMO

- We can't entirely rule out a couple more 0.25% rate cuts to cushion against the negative impacts of ongoing uncertainty - Oxford Economics

- Tariffs could stall economic recovery even as rate cuts provide relief to borrowers - Scotiabank

- We are ready for a competitive spring mortgage market and the upcoming wave of renewals - RBC

- There are still countless mortgage renewal offers where the lender tries to pull a fast one on an unsuspecting or less qualified borrower - Financial Post

- With tighter mortgage qualification rules and rising borrowing costs, up to half of homebuyers in Canada now rely on mortgage brokers - CMHC

- OSFI considering changes to mortgage stress test

- First-time homebuyers gravitating toward shorter fixed mortgage rates - Canadian Mortgage Trends

- 57% of homeowners renewing their mortgage this year expect their mortgage costs to rise - Royal LePage

- Canada hasn't seen a mortgage renewal crisis yet - but some are feeling the pain - MPA Mag

- Rocket Mortgage winding down Canadian operations - CBC

- Inflation in Canada was 1.9% in Jan. Feb data will be published on March 18

Housing Market

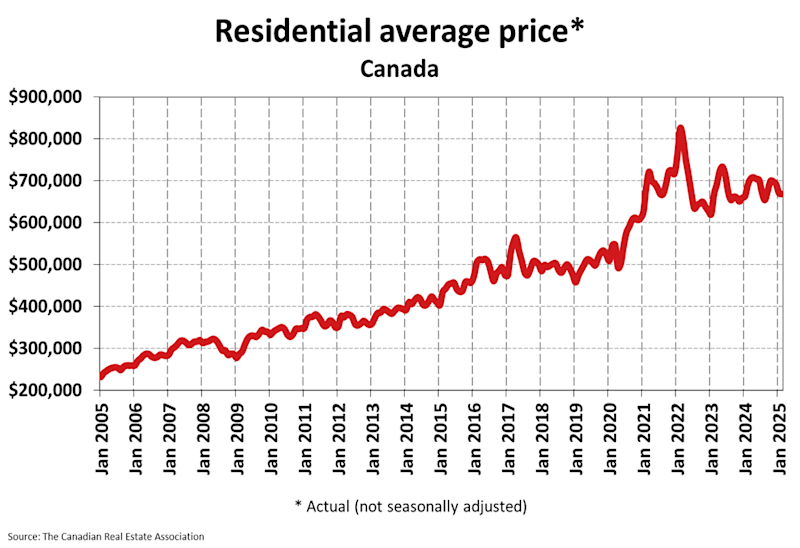

The MLS Home Price Index (HPI) was down 0.8% month-over-month in February 2025. The actual (not seasonally adjusted) national average sale price fell 3.3% year-over-year. The actual national average home price was $668,097 at the end of February 2025.

Housing Sales fell by 9.8% month-over-month in February 2025. Actual (not seasonally adjusted) sales were down 10.4% versus the prior year, February 2024.

Housing Market Headlines

- New listing activity in February declined 12.7% month-over-month - CREA

- Nationally, there were 4.7 months of housing inventory for sale at the end of February 2025, up sharply from 4.1 months at the end of January. The long-term average is closer to 5 months - CREA

- The uncertainty of the last few weeks seems to be causing some buyers to think twice about big financial decisions right now - CREA

- A softer pricing environment and now lower interest rates will be a buying opportunity - CREA

- Home sales dented by tariff worries - Canadian Mortgage Trends

- Trade turbulence shakes Canada's housing market foundations - RBC

- Vancouver's housing market seen on firmer footing than Toronto's heading into tariff turbulence - Financial Post

- The recent increase in Alberta's home sales was driven primarily by an increase in sales activity in Edmonton compared to last year, while Calgary is seeing a slump in sales yoy - Wowa.ca

- The Winnipeg spring housing market came early this year - CTV

- Roller-coaster housing market in Halifax may be coming to an end - Royal LePage

- Record GTA housing supply but most of the growth comes from condo - CMHC

- Housing starts rose 1.1% in February - CMHC

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.