Monthly Market Update - June 15, 2023

Housing market activity picked up in May, but mortgage rates are on the rise again.

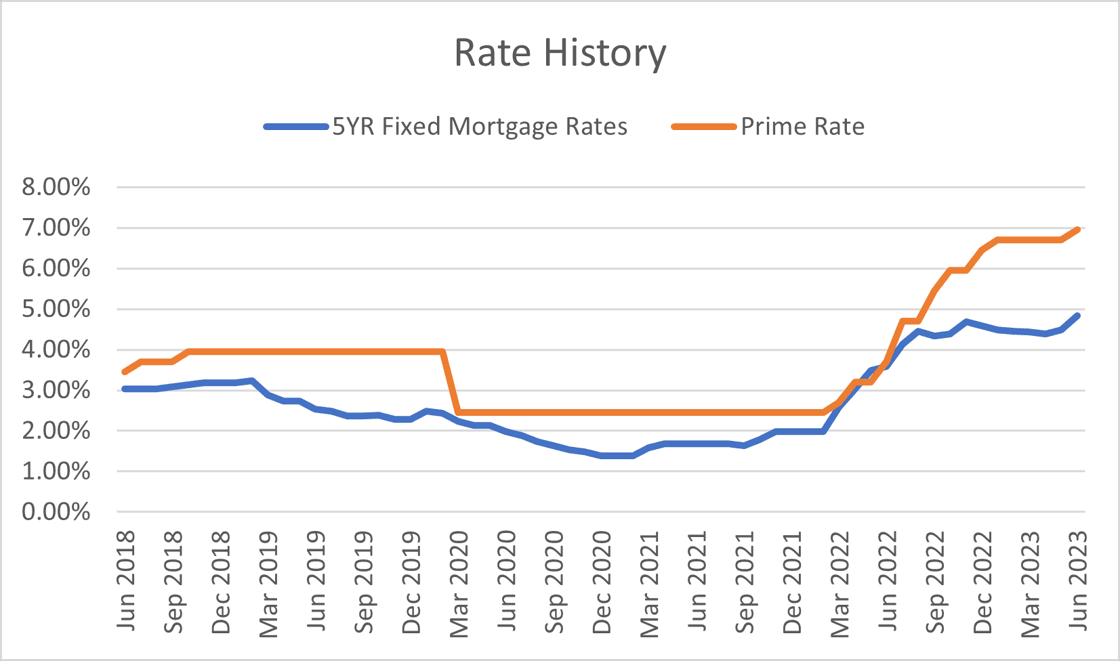

The Bank of Canada surprised with another 0.25% rate increase on June 7. Variable mortgage rates are higher as a result and fixed mortgage rates also increased in the past few weeks. Housing activity increased in May but increasing mortgage rates could cool expectations.

Mortgage Market

- Prime Rate - 6.95%

- On June 7 2023 the Bank of Canada increased their overnight rate by 0.25% to 4.75%. Continuing strong economic numbers and stubborn inflation led them to end their rate hike pause. The banks have responded by increasing their Prime rate to 6.95%

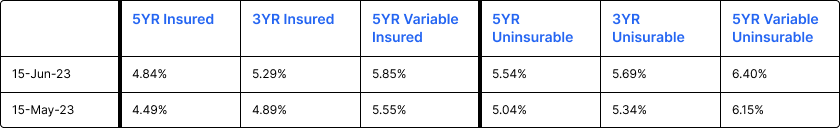

- Mortgage rates – month-over-month:

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Variable mortgage rates have increased by 0.25%. Lenders have increased their rates in response to the Prime rate increasing by 0.25% on June 7.

- Fixed mortgage rates are higher by close to 0.40%, compared to the prior month. Bond yields have increased leading to higher fixed mortgage rates.

- Short-term mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- Bank of Canada expected to hit market with two more rate hikes - BMO

- In Q1 2023, new mortgage originations were down 42% compared to a year ago - Equifax

- CMHC reports that over 65% of mortgage borrowers are opting for fixed rates, with close to 40% choosing shorter-term (3 years or less) fixed rate mortgages.

- CMHC reports that 37% of recent homebuyers received a gift to assist with their mortgage down payment. In the 18-24 age group, that number was higher at 43%.

- CMHC CEO says “No” to extended amortizations for new mortgages.

- The Bank of Canada has growing concern regarding the ability of households to service their debt. They also say existing mortgage holders could face payment increases of up to 40% at renewal but expect that to be manageable.

Housing Market

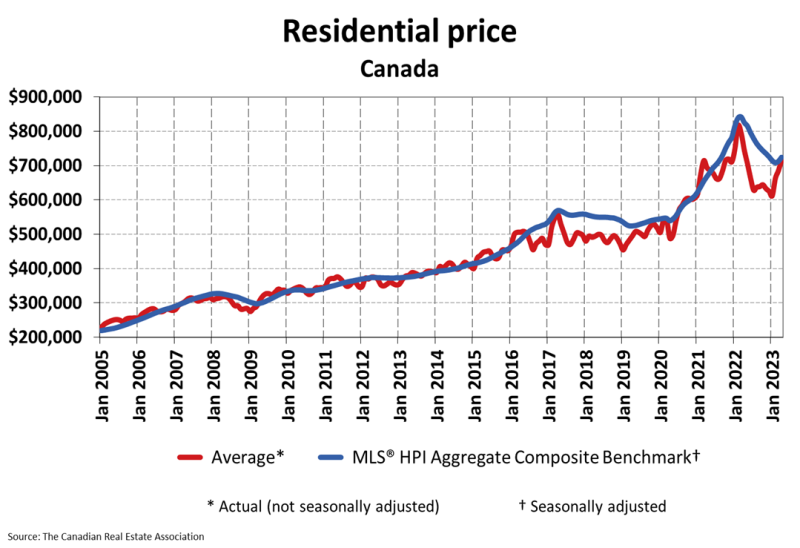

The MLS Home Price Index (HPI) was up 2.1% month-over-month in May 2023, but still down 8.6% compared to May 2022.

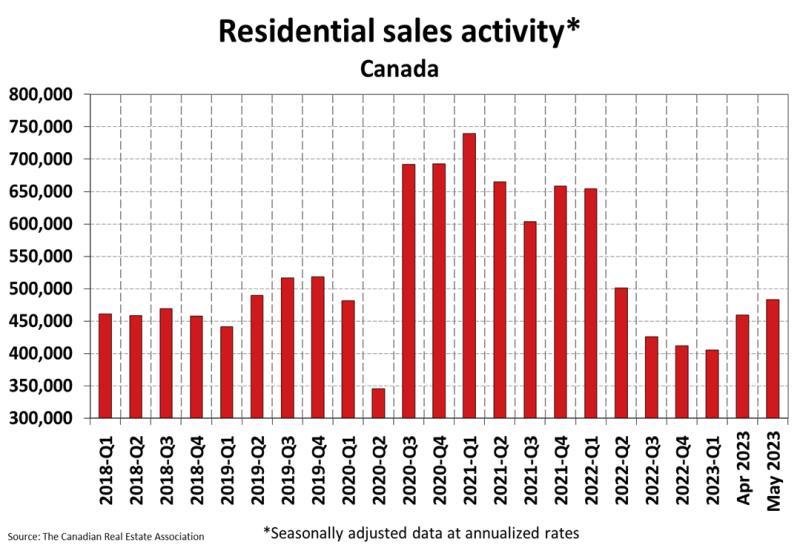

Housing Sales were up 5.1% month-over-month in May 2023. Actual sales were also up by 1.4% over the prior year, May 2022.

Housing Market Headlines

- New listing activity in May rose 6.8% month-over-month.

- House prices increased year-over-year for the first time in a year, with May 2023 prices up 3.2% versus May 2022

- In a recent survey by IG Wealth Management, 78% of Canadians believe home ownership is the most important part of their financial plan.

- According to recent survey by Sagen MI, “First-Time Homebuyers (43%) and future home buying intenders (36%) are far more optimistic than the general population respondents (13%) in Canada in thinking that this is a good time to buy a home given the state of their local real estate market.”

- 26% of Canadians intend to purchase an investment property within the next half-decade – Royal LePage

Do you have questions about getting a new mortgage or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.