Monthly Market Update - July 12, 2024

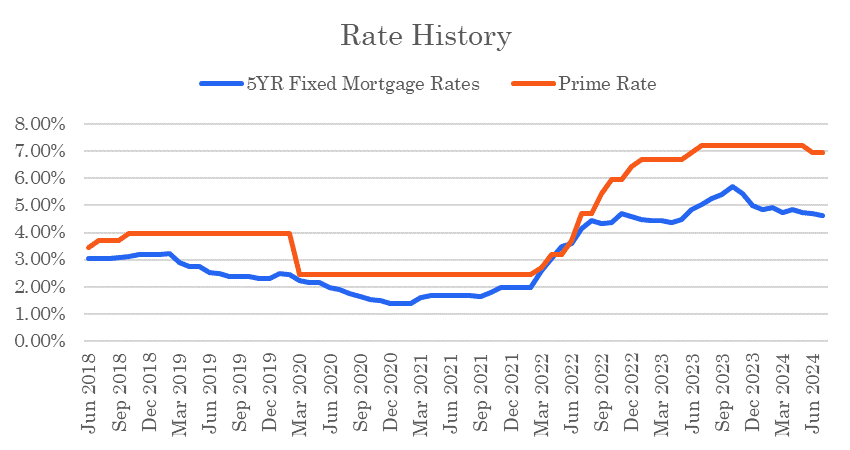

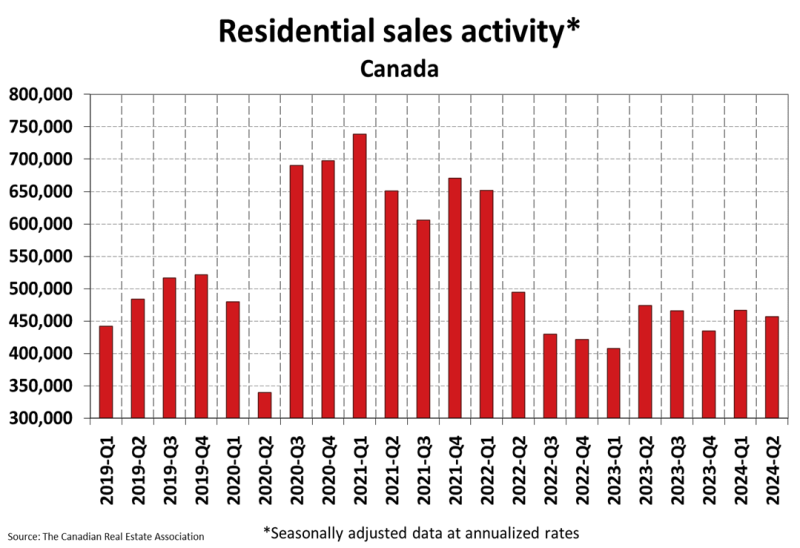

The Canadian mortgage and housing markets are looking for a spark. Housing sales were up slightly in June after the Bank of Canada rate cut, but mortgage affordability remains challenging. Mortgage rates declined immediately after the June 5th rate cut and fixed rates have declined further in early July. This decline in rates is positive but a single rate cut is not enough to make a material difference in mortgage affordability. More rate relief will be needed to bring the pent-up demand off the sidelines and stimulate further activity.

There are some material differences between the offered rates at lenders across the country. This is true for both new purchases and mortgage renewals. New and existing mortgage borrowers should shop around to find the best available deals.

House prices are up modestly month-over-month. Homes for sale inventory continues to build in most major markets. A buyers market is emerging as we see more situations where sellers are lowering prices to get deals done. The market remains quieter than usual for a spring/early summer market.

The next Bank of Canada rate announcement is scheduled for July 24. The financial markets currently place about a 69% chance on a rate cut in July.

At Frank Mortgage, we have been able to negotiate rates lower than the advertised rates at several lenders. The market is competitive and lenders will often provide discounts in a competitive situation. We can help you with that kind of negotiation.

Five-year bond yields have fluctuated over the past four weeks but are unchanged from this time last month. Fixed mortgage rates have declined month-over-month but lower bond yields will be needed before we see further reductions in these fixed rates. The lowest insured, five-year, fixed mortgage rate is now 4.64%.

Variable rates remain high and will only decline further in response to additional rate reductions by the Bank of Canada.

Mortgage Market

- The prime rate is unchanged at 6.95%

- Bond yields are flat. The market now awaits news on a possible second rate cut on July 24. Five-year insured mortgage rates below 5% are available at multiple lenders

- The five year government bond yield is 3.35% today, unchanged from last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Fixed mortgage rates have declined in the past month

- Fixed mortgage rates are more than 1% lower than variable mortgage rates

- Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- If inflation continues to ease and remains on a sustainable track to the 2% target, it is reasonable to expect further cuts to the policy interest rate - Bank of Canada

- Canadian mortgage borrowers experienced a slight reduction in homeownership costs in Q1 2024, despite affordability remaining close to its worst point ever - RBC

- 44% of mortgage holders accepted the initial rate offered by their lender during their last renewal - Mortgage Professionals Canada.

This indicates to us that more borrowers need to shop around for the best available deals on renewal. Just signing back the initial offer will cost you money. - With rising interest rates and affordability hurdles across Canada’s housing and mortgage markets, many alternative borrowers have no option but to either renew in the alternative space or sell their property - CMHC

- Monthly mortgage renewals will jump 52% over the next two years - Wowa.ca

- Over 1/3rd of new homebuyers in BC and Ontario received gifted funds for their down payment - CIBC

- House prices remain at elevated levels and mortgage rates have come down only marginally. If you want or need to buy now, affordability may depend on negotiating the best possible mortgage rate discount - Globe & Mail

- Inflation in Canada rose unexpectedly in May to 2.9% (versus expectations of 2.6%). The data for June will be released on July 16, 2024.

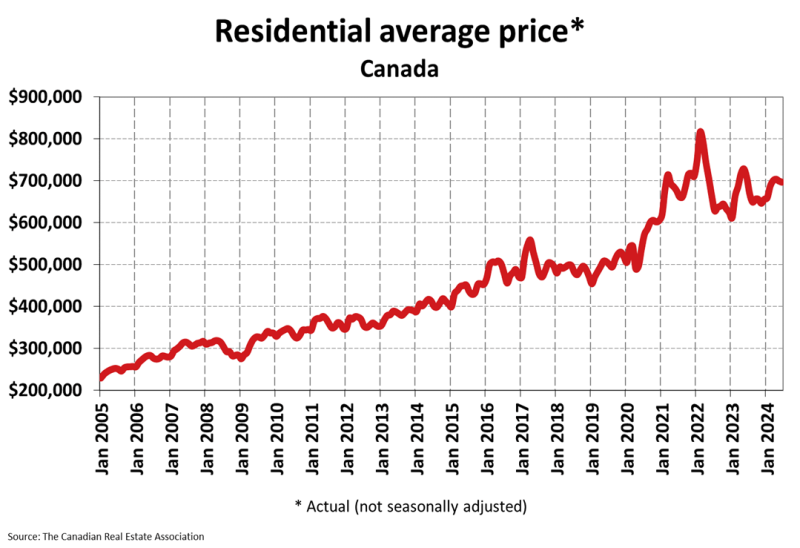

Housing Market

The MLS Home Price Index (HPI) increased by 0.1% month-over-month in June 2024. This was the first month-over-month gain in 11 months. The actual (not seasonally adjusted) national average sale price was down 1.6% year-over-year. The actual national average home price was $696,179 at the end of June 2024.

Housing Sales increased by 3.7% month-over-month in June 2024. Actual (not seasonally adjusted) sales were down by 9.4% over the prior year, June 2023.

Housing Market Headlines

- New listing activity in June rose 1.5% month-over-month - CREA

- Nationally, there were 4.2 months of housing inventory for sale at the end of June 2024. The long-term average is closer to five months - CREA

- Sales were up from May to June, market conditions tightened for the first time this year, and prices nationally ticked higher for the first time in 11 months - CREA

- Toronto and Vancouver report slower-than-usual market activity this spring as inventory builds, while demand continues to outpace supply in prairie provinces and Quebec - Royal LePage

- Regionally, prices are still generally sliding sideways across most of the country. The exceptions remain Calgary, Edmonton and Saskatoon, and to a lesser extent Montreal and Quebec City, where prices have steadily moved higher - CREA

- Housing affordability to slowly improve due to a combination of factors that includes falling interest rates, stable home prices, and rising incomes - BMO

- While the June rate cut could potentially stimulate activity, more substantial reductions are needed to attract budget-constrained buyers significantly. - RBC

- 11 per cent of homeowners planning to sell are doing so because of the cost of living, while 37 per cent are looking to downsize - Wahi

- Canada's housing market is struggling to find a consistent rhythm, as the last three months clearly demonstrated ... the silver lining: inventory levels in many regions have climbed materially. This is the closest we've been to a balanced market in several years - Royal LePage

- Canada's largest housing markets have experienced a spike in inventory as new listings grow while sales moderate - RBC

- Elevated borrowing costs and Bank of Canada uncertainty have kept buyers on the sidelines, leaving Canadian home sales at the lower end of their pre-Covid levels - TD

- Vancouver, Toronto ranked among world's most unaffordable cities for homebuyers - Demographia

- More than 25% of renters plan to purchase a home in the next two years - Royal LePage

- 28% of Canadians are seriously considering leaving their province because housing costs are too high. That number climbs to 39 per cent among people who have lived in Canada for 10 years or less - Angus Reid survey

Do you have questions about a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.