Monthly Market Update - February 12, 2024

Housing and mortgage market activity is picking up. With interest rates levelling off, buyers are returning to the market.

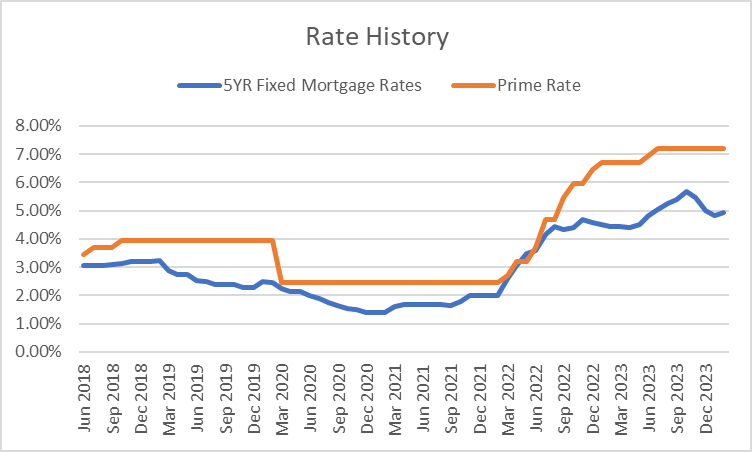

The Bank of Canada held rates unchanged at their scheduled announcement on January 24. They have not changed rates since July 2023. The Bank was less hawkish in their accompanying notes to this rate decision. They remain cautious about persistent inflation pressures but their language was softer about more potential rate hikes. This is good news and is the best indicator from the Bank that the rate hiking cycle is over for now.

After declining significantly from October to December, five-year bond yields have risen by over 0.50% since the start of this year. This has paused the decline in fixed mortgage rates and many lenders have started to increase their fixed mortgage rates this week. This may be a sign that fixed rates will fluctuate within a range for the time being. No significant reductions in fixed rates are being forecast in the near term. The lowest insured, fixed mortgage rates remain below 5%.

Variable rates remain high and will stay there until we see the anticipated rate reductions by the Bank of Canada.

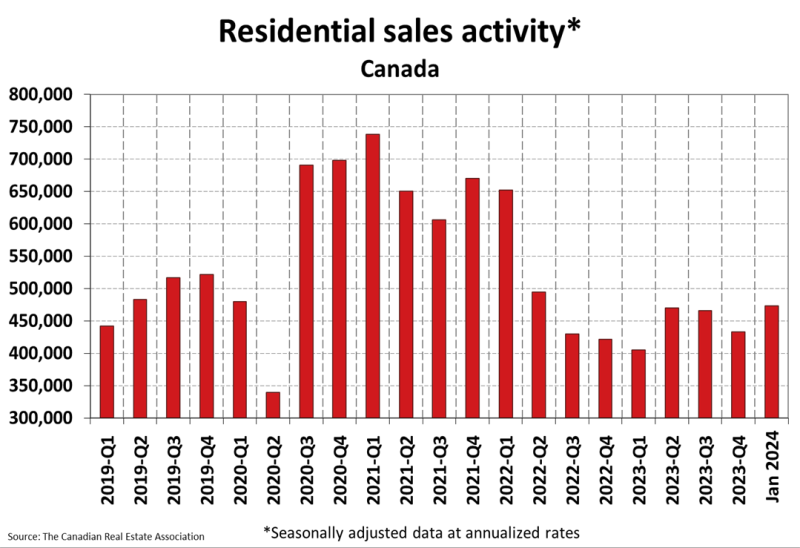

Housing sales in January rose again, a second consecutive month of gains. This signals increasing activity in the housing market and industry participants are feeling more encouraged about an active and healthy spring housing market.

Mortgage Market

- The prime rate remains at 7.20%

- Fixed mortgage rates declined in late Jan but have moved slightly higher this week. Five-year insured mortgage rates below 5% remain available with some lenders

- The five year government bond yield is 3.68% today, which is 0.51% higher than the end of 2023. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Fixed mortgage rates have levelled off with little change in the past month

- Fixed mortgage rates are more than 1% lower than variable mortgage rates.

- Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- The Bank could start lowering rates before headline inflation returns to 2% but will only start entertaining interest rate cuts once it has assurance that inflation is trending back toward its 2% target - Bank of Canada

- Strong employment data for January has caused several economists to postpone their timing expectations for 2024's first rate cut - Reuters

- Canada's financial regulator warned banks last week that fixed-payment variable mortgages can saddle homeowners with a "forever mortgage." The regulator is increasing capital requirements for banks that offer these mortgages - Toronto Star

- No more rate hikes, but an April rate cut is unlikely - CIBC

- The Canadian Home Builders’ Association (CHBA) urges the federal government to extend mortgage amortization periods to 30 years for newly built homes

- The expected decline in interest rates over the course of 2024 should help soften the impact of mortgage renewal payment shocks - RBC

- Inflation in Canada was higher than expected at 3.4% in December, up from 3.1% the prior month. January inflation data will be released on February 20

Housing Market

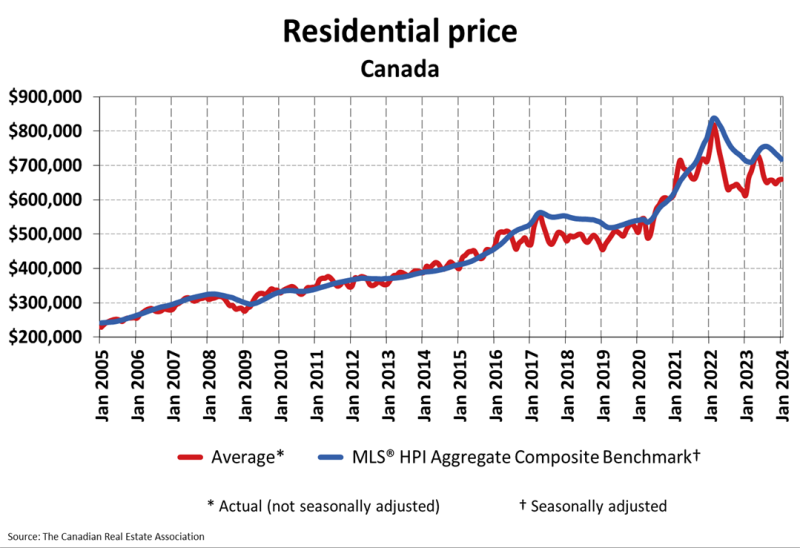

The MLS Home Price Index (HPI) was down 1.2% month-over-month in January 2024. The actual (not seasonally adjusted) national average sale price was up 7.6% year-over-year. The actual national average home price was $659,395 at the end of January 2024.

Housing Sales rose 3.7% month-over-month in January 2024. Actual (not seasonally adjusted) sales were up by 22% over the prior year, January 2023.

Housing Market Headlines

- New listing activity in January was up 1.5% month-over-month - CREA

- Nationally, there were 3.7 months of housing inventory for sale at the end of January 2024. The long-term average is closer to five months - CREA

- The actual number of transactions were 22% higher than January 2023, the largest y-o-y gain since May 2021 - CREA

- Following a weak second half of 2023, home sales over the last two months are showing signs of recovery - CREA

- Price declines have been predominantly located in Ontario markets, particularly the Greater Golden Horseshoe and, to a lesser extent, British Columbia. Elsewhere, prices are mostly holding firm or in some cases (Alberta and Newfoundland & Labrador) continuing to climb - CREA

- Investors account for 30 per cent of home buying in Canada - Globe & Mail

- 87% of respondents feel more comfortable investing in real estate compared to publicly traded stocks - Valour Group survey

- BoC's Macklin suggests that a housing market rebound is in store for this year

- House resale activity is set to rebound in the second part of the year - RBC

- Housing market to stabilize but affordability remains strained - BMO

- Housing supply shortage the cause of housing crisis, not interest rates - Bank of Canada

- Average national housing price to increase by 2.3% in 2024 - CREA

- The Federal Government extended the foreign buyer ban until 2027

- Housing supply gap is worse than thought - five million new homes needed by 2030 - CIBC

Do you have questions about a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.