Monthly Market Update - December 16, 2024

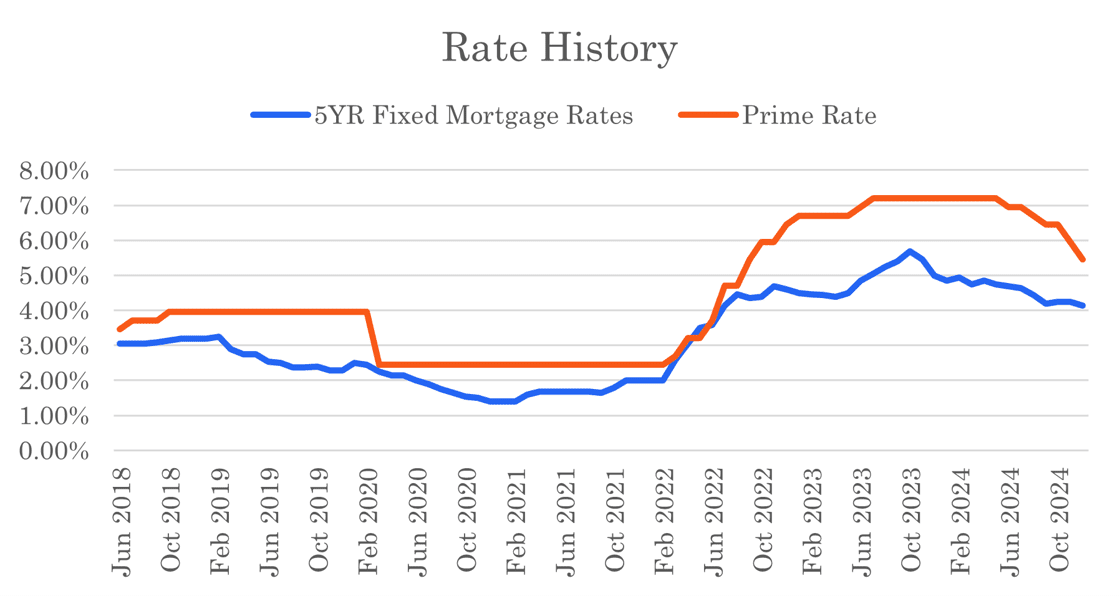

The Bank of Canada made their second consecutive 'super-sized' rate cut of 0.50% on December 11. In response, the prime rate dropped to 5.45%, providing relief to variable-rate mortgage borrowers. Bond yields did not change, leaving five-year fixed mortgage rates relatively stable.

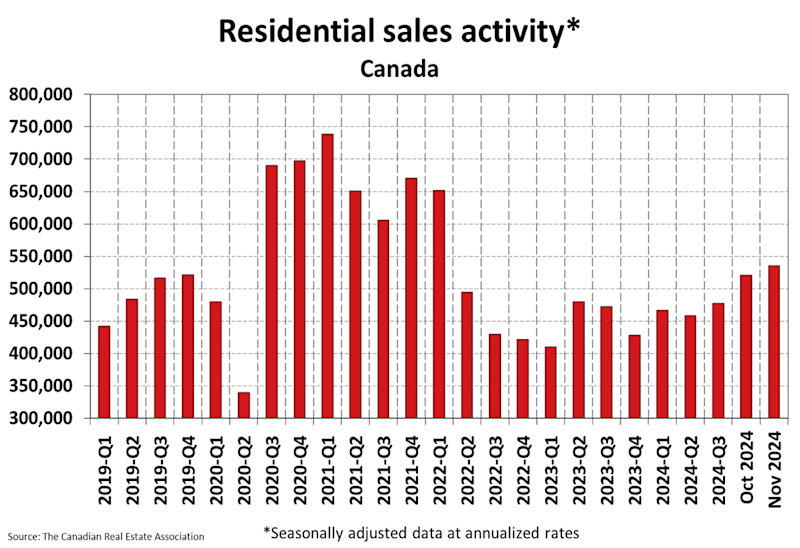

Housing sales increased in November and expectations of an early and active spring market in 2025 are increasing. Prospective buyers are reportedly coming off the sidelines. The recent increase in sales activity has lead to an increase in property values.

The rate cutting cycle continues, now with five consecutive cuts and more expected. The Bank of Canada makes their next interest rate announcement on January 29, 2025. However, the Bank has stated that they expect the future pace of rate cuts to be more gradual.

Five-year bond yields declined modestly in the past month but are flat to where they were two months ago. It appears that fixed mortgage rates are near their bottom. If this is true, then fixed mortgage rates may move around within a range from the high 3% to mid 4% range for the foreseeable future. While it is always possible that they may decline from today's rates, if you are waiting for fixed rates to drop significantly before entering the market, you may be disappointed.

Our best insured, five-year fixed mortgage rate is now 4.14% and best insured, three-year fixed mortgage rate is 4.19%.

Variable rates remain higher than fixed rates but the gap is closing. Variable rates dropped by 0.50% after the Dec 11 Bank of Canada rate cut. This moved our best insured, five-year, variable mortgage rate down to 4.40%. Variable rates will only decline further in response to additional rate cuts by the Bank of Canada.

Mortgage Market

- The prime rate is 5.45%

- Bond yields are a bit lower than last month. They have fluctuated throughout the month but have not declined enough for most lenders to change their fixed mortgage rates. Any recent changes in the best fixed rates are mainly due to competitive dynamics.

- The five year government bond yield is 2.99% today, down from 3.11% last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Variable mortgage rates declined by 0.50% in the past month

- Fixed mortgage rates remain lower than variable mortgage rates but the gap has narrowed and is now less than 0.50%

- Short-term fixed mortgage rates (1 & 2-year rates) remain higher than 5-year mortgage rates. The yield curve is flattening, however, and now 3-year mortgage rates are now comparable to 5-year rates.

- Stubborn fixed mortgage rates might not fall despite Bank of Canada cuts - Global News

- Two new key changes introduced by the federal government are in effect as of Dec 15:

1. Expanding access to 30-year amortizations for all first-time homebuyers and buyers of new build homes. This is aimed at reducing monthly payments.

2. Increasing the insured mortgage property value limit to $1.5-million. This makes it easier for buyers in high-cost markets like Toronto and Vancouver to qualify for a mortgage with a down payment below 20 per cent. The minimum required down payment on a $1.5 million home is now $125,000 versus $300,000 previously.

- The affordability boost offered by these measures will likely erode as home prices are raised by their implementation, thereby limiting their effectiveness - TD

- Any new rules that help first-time homebuyers are welcome, but they don't fix the underlying issues of affordability and supply - Royal LePage

- OSFI's stress test on uninsured mortgage switches ended on Nov 21. Borrowers can now move to a new lender on renewal without being stress tested

- Mortgage owners facing less pressure amid looming renewals - BNN Bloomberg

- Mortgage borrowers renewing in 2025 to face an average $513 monthly payment increase - RBC

- Declining rates can ease mortgage renewal shock - TD

- More than one million Canadian mortgages are up for renewal in 2025 - CTV News

- Variable-rate borrowers are operating on the assumption that Canada’s benchmark prime rate will keep dropping. That’s a correct assumption only if most economists and the bond market’s outlook is true, but it says nothing about how long rates will stay down - Financial Post

- Rate cuts are easing financial pressure for some, but newcomers and those with limited credit history are struggling - Equifax

- Sign a mortgage when rates were at their highest? Breaking it could save you money - Globe & Mail

- Canadian mortgage rates won't get much lower; likely to rise in 2026 - Oxford Economics

- Inflation in Canada rose to 2.0% in Oct. Data for Nov will be released on Dec 17.

Housing Market

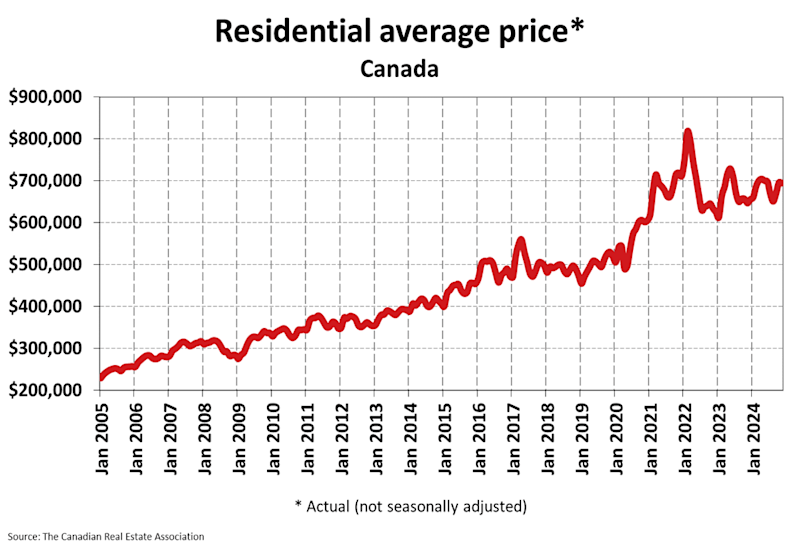

The MLS Home Price Index (HPI) declined 0.6% month-over-month in November 2024. The actual (not seasonally adjusted) national average sale price was up 7.4% year-over-year. The actual national average home price was $694,411 at the end of November 2024.

Housing Sales increased by 2.8% month-over-month in November 2024. Actual (not seasonally adjusted) sales were up 26% over the prior year, November 2023.

Housing Market Headlines

- New listing activity in November declined 0.5% month-over-month - CREA

- Nationally, there were 3.7 months of housing inventory for sale at the end of November 2024. The long-term average is closer to 5 months - CREA

- October and November marked the start of the long-awaited rebound in resale housing activity, with the combination of lower borrowing costs and more properties to choose from coaxing buyers off the sidelines - CREA

- Not only were sales up again, but with market conditions now starting to tighten up, November also saw prices move materially higher at the national level for the first time in almost a year and a half - CREA

- Stability returns to the Canadian housing market; prices to rise 6% in 2025 - Royal LePage

- Experts are forecasting an early start to the spring housing market in 2025 - Wealth Professional Magazine

- Widespread residential price growth expected in 2025, as interest rate cuts prompt market rebound - RE/MAX

- Toronto home prices set to rise in 2025 but condo market on a different trajectory - Royal LePage

- Vaughan, ON drops development charges dramatically to spur housing starts - Global News. Let's hope this is the start of a trend

- The price of a home in Calgary is forecast to rise 4% in 2025 - Royal LePage

- Toronto condo sales down 84% from last year - Better Dwelling

- Many British Columbians feeling priced out of housing market - Globe & Mail

- Vancouver home sales surged 28% in November - Vancouver Sun

- Development charges, which started off as a defensible policy, have morphed into one that penalizes new buyers and stands in the way of building homes as quickly and cheaply as possible - Globe & Mail

- Repurposing government-owned land could provide homes for one million Canadians - Real Estate Magazine

- The federal government’s revised immigration targets may not ease Canada’s housing shortage as much as officials project - Parliamentary Budget Officer

- Housing starts were up 8% in October - CMHC

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.