Mortgage Amortization Explained

Mortgage amortization is the process of paying off a mortgage loan over time through regular payments. As your mortgage amortizes it allows you to build equity in your home. Amortization is different from the mortgage term, which is the length of time that the current mortgage contract is in effect. In Canada, the mortgage term is usually five years or less. The most common amortization period is 25 years, but 30 years is being seen more often due to the combination of high house prices and increasing interest rates

How does mortgage amortization work?

When you make a mortgage payment, a portion of the payment goes towards paying off the principal (the amount you borrowed) and a portion goes towards paying interest. During the early years of the amortization period, a larger portion of the payment goes towards paying interest, while a smaller portion goes towards paying off the principal. This is due to the simple math of calculating the interest as a percentage of the outstanding principal balance – when the balance is higher, the interest amount will also be higher. As the amortization period progresses, the portion of the payment that goes towards paying off the principal increases as the portion that goes towards interest decreases. This means that you will pay more towards the principal in the later years of the amortization period.

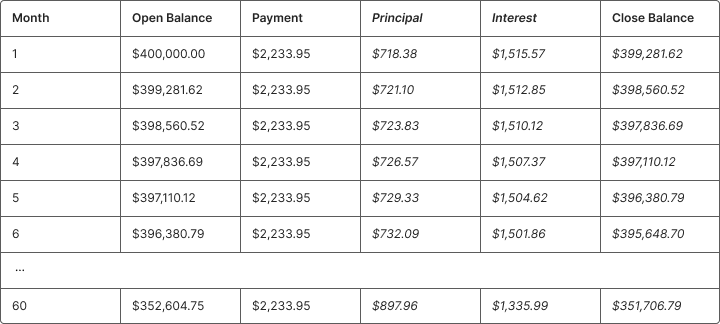

Here is a shortened example of an amortization table for a $400,000 five-year fixed-rate mortgage at an interest rate of 4.59% and an amortization period of 25 years.

Each month the interest portion of the payment declines and the principal portion increases. It is a small difference between each period but by the last month of a five-year mortgage (month 60) the difference from the initial month is material.

What amortization period is best for me?

When it comes to choosing an amortization period, it's important to consider your financial situation and goals. A longer amortization period will result in lower monthly payments, which can be helpful if you have a tight budget or want to free up some cash for other expenses. However, a longer amortization period also means that you will pay more in interest over the life of the loan. On the other hand, a shorter amortization period provides you with higher monthly payments, but you will pay less in interest over the life of the loan.

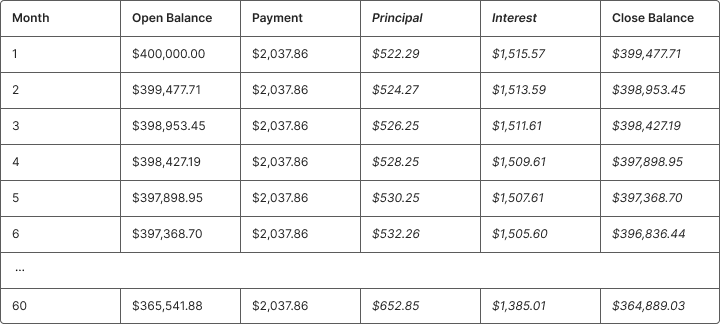

Take a look at the difference between the monthly payments for a mortgage with a 25-year amortization shown in the table above and a mortgage with a 30-year amortization period in the following table:

The 25-year amortization period produces a monthly payment of $2,233.95 compared to the 30-year amortization of $2,037.86. The longer amortization can result in a more affordable mortgage payment. However, note that the balance after 60 months from the 25-year amortization is $352,604.75. The balance after 60 months from the 30-year amortization is $365,541.88. This higher balance that needs to be renewed upon the maturity of the initial five-year mortgage term shows how the longer amortization period will cost more in interest over time.

Do fixed and variable rate mortgages amortize the same way?

At the start of a fixed rate mortgage the amortization table is set and won’t change. The amortization schedule for a variable-rate mortgage depends on the variable payment type.

For an adjustable-rate mortgage, as interest rates change the payment changes. The principal amount of the payment is predetermined, as with a fixed rate mortgage, but the interest component will change as rates move up or down. This means the monthly payments will increase or decrease with rates, but the principal amortization schedule is set at the beginning of the mortgage.

For a variable-rate mortgage with static payments, borrowers take some comfort from the idea that the payments won’t change over time. However, this does not mean you are not exposed to interest rate risk. The interest component of the payment changes over time as rates change. This means that the principal portion of the payment can also change over time. As rates increase, the interest component of the payment increases. When this happens, the amount of the payment going to principal decreases. As rates decrease, the interest component decreases. When this happens, the amount of the payment going to principal increases. This means that as rates change, the amortization schedule will change. If rates decline and more of the payment goes to principal, the amortization will decline faster than originally calculated. If rates increase and less of the payment goes to principal, the amortization will decline slower than originally calculated. These static payment variable-rate mortgages may seem attractive since they keep payments unchanged in most scenarios, but they are a dangerous product. As we have recently seen, if interest increases enough to make the required interest payment larger than the static payment set at the beginning of the mortgage, the mortgage may go into negative amortization.

Negative amortization means that even when you make payments, the principal balance of the mortgage increases. If your lender allows you to maintain the same monthly payment amount on your static payment variable-rate mortgage, even when the interest component is larger than the payment amount, the unpaid interest gets added to the principal balance. Even if a lender allows this, they will likely only allow it to occur until the principal balance reaches a certain amount, after which they will require you to increase your monthly payment. We believe that these static payment variable-rate mortgages are flawed. Negative amortization is a risk that all borrowers should avoid.

Can I reduce my amortization period over time?

There are several ways you can reduce your amortization period over time:

Increase your payment frequency – most mortgages have a monthly payment frequency. You can ask your lender to increase the frequency to bi-monthly or weekly. This does not increase your total required payment, but it will amortize the mortgage more quickly;

If you are renewing your mortgage at a rate lower than the original mortgage rate, you may want to keep your payment the same. This increases the principal component of the payment and will speed up the amortization of the remaining mortgage;

You can voluntarily increase your payment amount. Most mortgage products allow you to increase your monthly payment by a certain amount (often between 10% and 20%) without a penalty;

Make a lump sum prepayment on the mortgage. Most mortgages allow annual prepayments of up to 10% or 20% of the mortgage principal balance without penalty. A prepayment will reduce the principal balance, reducing the remaining amortization of the mortgage.

Mortgage amortization – the bottom line

Mortgage amortization is the process of paying off a mortgage loan over time through regular payments. It is important to consider your financial situation and goals when choosing an amortization period. A longer amortization period may make it easier to qualify for a mortgage since the payments are lower but will result in higher lifetime interest costs for your mortgage. If you can afford it, a shorter amortization period is the prudent decision. There are also several ways you can reduce your amortization period over time, such as making prepayments or increasing your payments.

Compare all your mortgage options before deciding on a mortgage. Do your research and understand how amortization affects mortgage affordability. Please contact us at Frank Mortgage to discuss all your mortgage options. We provide unbiased advice in an open and transparent manner. Our priority is generating positive outcomes for clients. We can be reached at 1-888-850-1337 or at www.frankmortgage.com.

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.