Does a Variable Rate Mortgage Make Sense Today?

Should A Borrower Prefer Variable or Fixed Rate Mortgages?

As we embark on a new year, 2024, there is optimism in the markets that interest rates will decline. Inflation peaked over a year ago and many market participants are now predicting material rate reductions by the Bank of Canada this year.

A variable-rate mortgage might make sense for some clients who want to benefit from anticipated rate declines. However, the math is not clearly in favor of variable rates, and we caution homeowners to temper their expectations about when rates will decline and by how much.

Are Expectations for Lower Interest Rates Realistic?

Nobody has a crystal ball for future interest rates. Look no further than all the incorrect predictions about inflation and interest rates over the past three years. Almost everyone got it wrong. Despite this, consumers of information are reading the 2024 predictions from the same analysts that got it wrong in recent years and taking them to heart. Perhaps, a sober second look at the situation will help.

There is a general consensus that rates will decline in 2024 but we do not believe that the path to lower rates will be a straight line. Just look at the inflation data published on Jan 16. Inflation increased in December to 3.4% from 3.1% in November. The underlying core inflation numbers were all higher than expected. As a result, bond yields rose by close to 0.30% within a few days and expectations of an April Bank of Canada rate cut have all but dissipated.

The big five banks think that the Bank of Canada will cut rates by between 1.0% and 1.5% in 2024, with the cuts mostly occurring in the latter half of the year. Many optimists predict that rate cuts will be even larger than this over the next two years. The view that a recession will cause significant rate cuts may be realistic, but we need to put today’s rates in context.

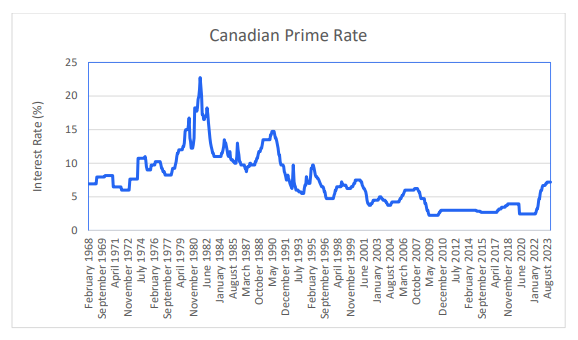

Canada’s Prime Rate History

The main things to learn from history are:

- If the central bank does not get inflation under control, rates can move much higher as we saw happen in the early 1980’s and 1990’s. Central bankers are determined to avoid a recurrence of this scenario, emphasizing their commitment to raising rates to contain persistent inflation. Let’s hope the spikes in the above graph do not happen again;

- The current prime rate is at the historic average going back many decades but if you look at just the past 30 years, the average prime rate is 4.53%.

Will Mortgage Rates Drop Materially?

Considering the average over the past 30 years, if inflation returns to normal (i.e. 2.0%), wouldn’t it be reasonable to assume that the prime rate would return to a level close to this average? That would mean a decline of over 2.5% from today’s prime rate of 7.20%. This does not mean such a decline happens quickly. Inflation pressures persist. However, at some point in the future, a reversion back to historical averages should occur.

We doubt that rates will decline to the exceptionally low interest rates of 2021, when the prime rate bottomed out at 2.45%. This period of rate history is an anomaly that central banks are likely to avoid repeating.

Pay attention to the inflation numbers for guidance. If they continue to decline, interest rates will decline and a return to a more historically normalized rate environment may materialize.

The current expectation for lower rates has improved market sentiment. We suspect that this sentiment shift is more important to the overall market than the absolute amount of the rate decline. An enemy of a healthy market is uncertainty. The latter half of 2023 was marked with uncertainty as participants couldn’t be sure if rates would continue to go up, level off or decline. It now appears that the peak in rates has arrived, and the direction of rates is down. This relative level of certainty creates market conditions conducive to new business activity

How to Choose Between Fixed and Variable Mortgage Rates?

The choice of a fixed rate vs variable rate mortgage is a personal one. It primarily depends on your budget and your risk tolerance. Are you willing to take the chance that variable rates will rise, costing you money in the form of higher monthly mortgage payments or extended amortizations? Are you, on the other hand, willing to lock in a fixed rate mortgage today, knowing that if rates fall, you will not benefit during the term of the mortgage?

Variable-rate mortgages may be right for some borrowers, but not all. Most Canadian mortgage borrowers tend to prefer stability and minimal risk. Fixed rates provide this, allowing a borrower to lock in rates for several years and not have to worry about where rates are going.

Variable-rate mortgage borrowers expose themselves to interest rate risk. If rates decline, they will benefit. If rates increase, these borrowers will pay more. If you have the stomach for it and can afford to be wrong on your rate prediction, then variable rates might be right for you.

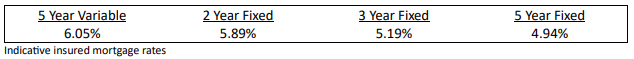

Now that the market expects rates to begin declining, it might make sense to consider a variable-rate mortgage. Unfortunately, this decision is challenged by the inverted yield curve. Let’s look at rates today (Jan 25, 2024):

Variable mortgage rates are usually lower than five-year fixed mortgage rates. This is because the usual shape of the yield curve is positive, meaning longer term rates are higher than shorter term rates. Variable rate mortgages are priced off short-term interest rates.

An inverted yield curve happens when short-term interest rates are higher than longer term rates. We have now been in an inverted yield curve environment for over a year. Inverted curves are not the norm, but they do happen, and they tend to last for a period of a few months to up to close to two years. The current inversion has now lasted for 18 months, the longest since 1980.

To decide to take a five-year variable rate mortgage today means you are accepting to pay over 1% more in interest than the fixed rate equivalent until rates decline.

If rates do not decline, or if they do not decline as much as many analysts predict, you could be paying significantly more for your mortgage with a variable rate. If we assume that the Bank of Canada cuts rates by 1% in 2024, the variable rate at the end of the year will be 5.05%, still higher than the five-year fixed rate today of 4.94%. For you to break even on the mortgage you would need variable rates to decline more than an additional 0.50% in early 2025 and remain there for the life of the mortgage. That is to just break even. Only if variable mortgage rates decline more than 1.5% would you benefit.

Of course, variable-rate mortgages have lower prepayment penalties so borrowers looking for that kind of flexibility can still benefit from a variable-rate mortgage. From a purely cost of borrowing perspective, however, rates must decline significantly for a variable-rate mortgage to make sense.

Will Mortgage Rates Decline in 2024?

We present for your consideration the positive and negative views on this question.

Yes, Mortgage Rates Will Decline in 2024

Inflation peaked at 8.1% in June 2022. In December 2023 it was at 3.4%. This is a material decline. The trend is clearly positive. The Bank of Canada says that if the declining trend continues consistently then they will be able to cut rates. Most analysts predict that this will happen, allowing the Bank to cut rates as early as June 2024. These cuts are expected to be between 1.0% and 1.5% by the end of 2024. This would provide material rate relief for existing variable-rate mortgage holders and improve the math for new variable-rate borrowers.

No, Mortgage Rates Will Not Decline in 2024

Core inflation pressures persist. The recent inflation data in Canada for December was not positive. Many of the macro-level issues that influence inflation are not resolved. Things like the decline in the trend toward globalization, wars, restrictions on shipping routes, upward pressure on oil & gas prices, uncertainty around the US election cycle and mounting government debt are all inflationary. They are also hard to predict. In addition, the US economy continues to produce relatively positive economic numbers. Continuing upward pressure on inflation should temper any hopes of material rate reductions.

Accurately predicting future interest rates is nearly impossible. Keep an eye on the market for guidance but try to focus on affordability when considering financing a home. If your buying decision depends on lower future rates you are exposing yourself to risk that may work against you.

Does a Variable-Rate Mortgage Make Sense Today?

A variable rate can be attractive because you benefit from declining rates and in the long run, variable rates tend to be lower than fixed rates. That view is less appealing today given the inverted yield curve, but this inversion cannot last forever.

Trying to predict the future is difficult. We submit that it is also not wise to position your home for gain or loss on your best guess for the future direction of interest rates. Your mortgage broker or sales advisor at a bank are paid for providing mortgage expertise to help with your borrowing decisions, not for macro-economic forecasting. The argument that variable rates are better than fixed rates because rates will certainly decline assumes that the person giving this advice has a crystal ball for predicting future interest rates.

Instead of trying to predict where rates are going, focus on what you can afford. Consider short-term fixed rates if you believe that rates will be lower in two or three years. You can benefit from lower rates without exposing yourself to variable-rate risk. Most borrowers today continue to prefer fixed rates. If you want a variable rate today, make sure you understand how much rates need to drop for you to benefit and also be aware of what can happen if rates unexpectedly increase.

How to Choose the Best Mortgage Rate

The best thing to do is shop around. Simply finding out what your bank will do for you will not get you the best mortgage rate. No single lender has the best rates every day. You need to see a variety of lender alternatives to find the best mortgage rates.

Traditional mortgage brokers can show you rate options but usually limit what you see. Online rate shopping sites show you a variety of mortgage rates but do not manage the mortgage process for you.

There is a new kind of online mortgage broker, called Frank Mortgage, which shows you a wide variety of the best rates. We can show you the best mortgage rates in Ontario, the best mortgage rates in BC, the best mortgage rates in Alberta and elsewhere across Canada. We also operate as an unbiased mortgage broker that can handle the mortgage process for you.

Not only do we handle the process for you, but we personalize your mortgage journey. We provide you with the information you need to make a proper assessment of fixed or variable mortgage rates so that you can make an informed decision about your mortgage.

If you are looking for today’s mortgage rates you can find them here:

Related Pages

- https://www.frankmortgage.com/blog/shopping-around-for-your-mortgage-can-save-you-thousands

- https://www.frankmortgage.com/blog/a-beginners-guide-to-the-mortgage-process

- https://www.frankmortgage.com/blog/fixed-vs-variable-rate-mortgages

- https://www.frankmortgage.com/blog/mortgage-affordability

- https://www.frankmortgage.com/blog/mortgage-pre-approval

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.