The Prime Rate in Canada

Why Does it Matter to Mortgage Borrowers?

Canadian mortgage borrowers have experienced stress in recent years due to increasing interest rates. News headlines commonly refer to the prime rate, noting the frequent increases in the prime rate and the impact it has on variable-rate mortgage borrowers. Recently the prime rate has been declining. This is good news but, as a mortgage borrower, do you understand how the prime rate affects you?

What is the prime rate?

The prime rate in Canada as of March 12, 2025 is 4.95%.

The prime rate is most commonly defined as the interest rate commercial banks charge their most credit-worthy customers. It serves as a benchmark rate for setting the rates on a variety of financial products, including mortgages, personal loans, and lines of credit. The prime rate is influenced by a number of factors, including inflation, economic growth, and the supply and demand for credit.

The prime rate is determined by the banks themselves, and it is typically set at a level that is 1.5 to 2.5 percentage points above the overnight lending rate (aka: the Policy Rate) set by the Bank of Canada.

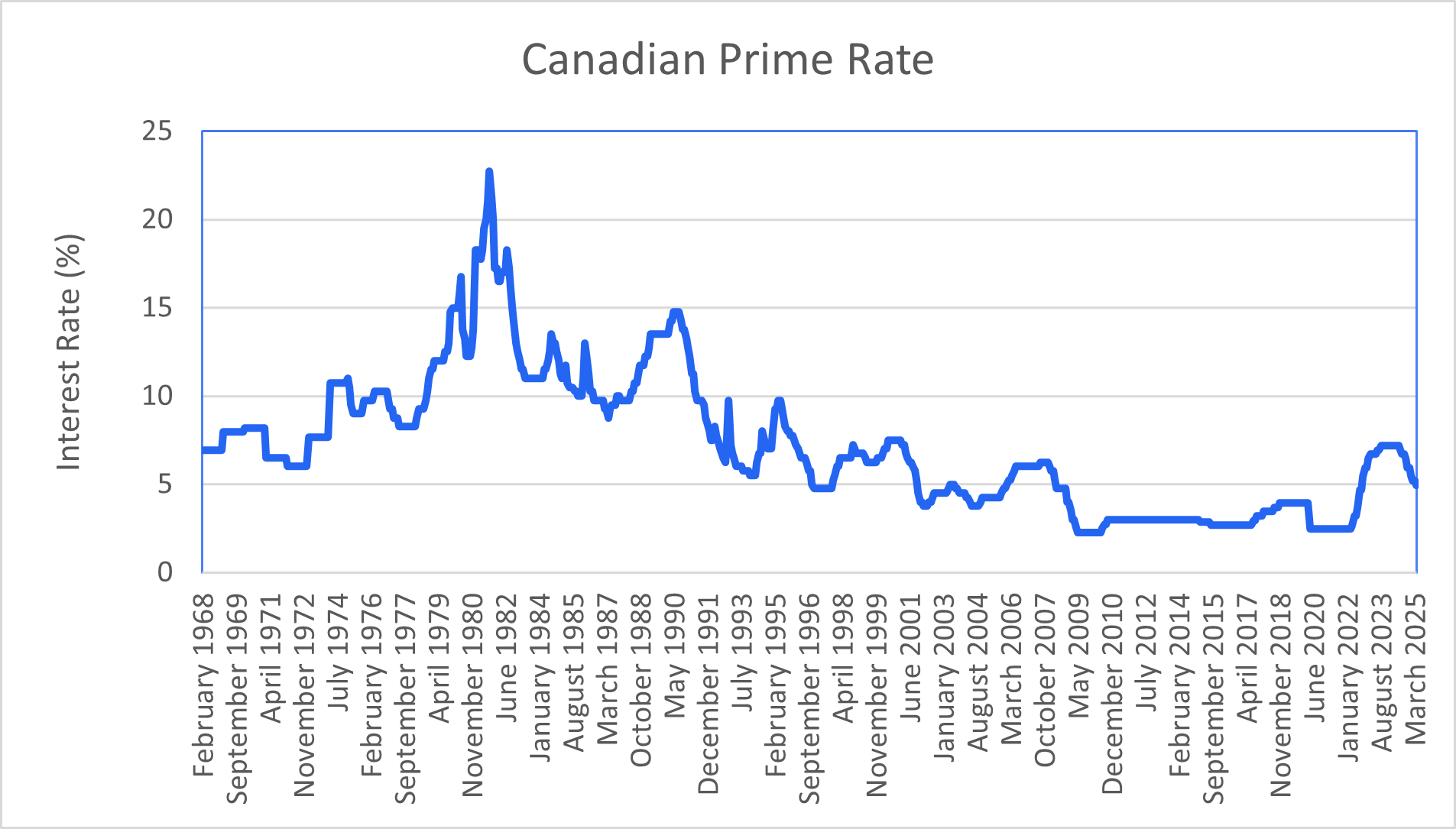

The current prime rate appears high to us today, partly due to the fact that is has been unusually low over the past decade. The average Prime Rate over the past 50 years is 7.23%, higher than today. However, the average over the past 20 years is 3.75%. Compared to more recent history, the prime rate is high at 4.95%.

How is the prime rate determined?

The Bank of Canada's monetary policy is a key determinant of the prime rate even though it does not directly set the rate. The Bank of Canada uses its benchmark overnight lending rate to regulate the nation's economic growth and restrain inflation. The Bank of Canada influences short-term interest rates by adjusting the target for the overnight rate. They make eight rate announcements each year, sometimes changing rates and sometimes keeping them unchanged. When the Bank of Canada changes their policy rate, the prime rate charged by banks changes as well. The dates when they have changed rates and the impact on the prime rate are below:

| Date | Prime Rate | Change |

|---|---|---|

| Mar 2025 | 4.95% | -0.25% |

| Jan 2025 | 5.20% | -0.25% |

| Dec 2024 | 5.45% | -0.50% |

| Oct 2024 | 5.95% | -0.50% |

| Sep 2024 | 6.45% | -0.25% |

| Jul 2024 | 6.70% | -0.25% |

| Jun 2024 | 6.95% | -0.25% |

| Jul 2023 | 7.20% | +0.25% |

| Jun 2023 | 6.95% | +0.25% |

| Jan 2023 | 6.70% | +0.25% |

| Dec 2022 | 6.45% | +0.50% |

| Oct 2022 | 5.95% | +0.50% |

| Sep 2022 | 5.45% | +0.75% |

| Jul 2022 | 4.70% | +1.00% |

| Jun 2022 | 3.70% | +0.50% |

| Apr 2022 | 3.20% | +0.50% |

| Mar 2022 | 2.70% | +0.25% |

| Mar 2020 | 2.45% | -0.50% |

| Mar 2020 | 2.95% | -0.50% |

| Mar 2020 | 3.45% | -0.50% |

| Oct 2018 | 3.95% | +0.25% |

There are times, such as when the Covid outbreak began, that the Bank of Canada may meet more frequently to set rates. They did so three times in March 2020.

When the Bank of Canada changes the overnight rate, the Canadian banks usually change their prime rates within a couple days. They tend to move their prime rates by the same amount and in the same direction that the Bank of Canada moves the overnight lending rate.

How to find the prime rate in Canada online

An online search of ‘prime rate in Canada’ should produce a result. Just be sure it is the current Canadian prime rate you find since the rate can change several times throughout the year. You can also find the prime rate for any particular big bank on their website. The Bank of Canada also posts daily updates for a variety of market rates, including the prime rate, here - https://www.bankofcanada.ca/rates/daily-digest/

How do banks use the prime rate?

Banks use the prime rate as a benchmark rate for a variety of financial products, including mortgages, personal loans, and lines of credit. The interest rate charged for these products is typically set at a margin above or below the prime rate. Most products will have a rate of Prime plus a margin but variable-rate mortgages for the best borrowers are usually priced at Prime minus a margin. For example, a bank might offer a variable-rate mortgage at a rate of prime minus 1% (equal to 3.95% today). As the Prime Rate moves up or down, the variable mortgage rate will move also, but the margin stays the same for the term of the mortgage.

How are variable mortgage rates set relative to the prime rate?

Variable rate mortgages are directly tied to the prime rate. When the prime rate goes up, so does the interest rate on a variable rate mortgage. Conversely, when the prime rate goes down, so does the interest rate on a variable rate mortgage. This means that borrowers with variable rate mortgages are exposed to interest rate risk, as the cost of their mortgage will increase if the prime rate increases.

The margin relative to the prime rate depends on market conditions, the risk profile of the borrower and the costs of lending. When market conditions are positive, the margin for the best borrowers can be as much as minus 1.50%. When market conditions worsen, that margin can be as small as 0.25% to 0.50%.

The prime rate is usually the same for all banks. They will use their prime rate for pricing variable rate mortgages and the competitive difference in rate between the banks is the margin below the prime rate that they offer. However, there is one bank that does things differently. TD Bank uses a prime rate for mortgage lending that is equal to their prime rate plus 0.15%. They have been doing this since 2016. Borrowers should note this since TD needs to offer a larger margin discount to their prime rate to get you to the same rate being offered by other lenders.

| Rate | Target Overnight Rate | Prime Rate | Variable Mortgage Rates |

| Who Decides | Bank of Canada | Banks | Banks & other lenders |

| Current Rate | 2.75% | 4.95% | Between 3.95% and 6.0% |

What is the historic margin between variable mortgage rates and the Prime Rate?

The historic margin between variable mortgage rates and the prime rate has varied over time. In general, the margin tends to be a discount ranging between 0.25% and 1.5%, depending on market conditions and the risk profile of the borrower. During times of economic uncertainty or when credit conditions are tight, banks may offer less of a discount margin to account for increased risk.

For those of you that are looking to get a Heloc, you should note that the rate for a Heloc will be higher than for a variable-rate mortgage. Helocs carry an interest rate that is usually prime plus a margin. This margin can range between 0.50% and 3.0% at the banks.

Can anyone predict where the prime rate will go in the future?

Predicting where the prime rate will go in the future is difficult. It is influenced by a wide range of factors and, as we saw in 2022, can be subject to sudden changes. Some economists and analysts use models to forecast the future direction of interest rates, but these projections are often imprecise and subject to error. Ultimately, the direction of the prime rate will depend on a variety of economic factors that influence the rate setting policy of the Bank of Canada, including inflation, economic growth, and the supply and demand for credit.

Most Recent Bank of Canada Rate News

The Bank of Canada lowered its overnight policy rate by 0.25% on March 12 from 3.0% per cent to 2.75%. This is their seventh consecutive cut and comes amid slowing economic momentum and growing uncertainty over tariff tensions. While this is good news for variable-rate mortgage borrowers it is indicative of darkening economic clouds hanging over Canada.

After the rate cut in January, the market expected steady economic growth and at least a brief pause in further cuts. A political environment that creates uncertainty can curb economic activity, as slower than expected Q1 economic growth demonstrates. The fear and uncertainty has escalated in the past month and we may see reduced economic activity until it settles down. The Bank of Canada referred to the uncertainty from the tariff showdown as a key reason for this cut.

The prime rate and variable mortgage rates will decline by 0.25%, bringing some relief to variable-rate mortgage holders. Variable mortgage rates are now very close to fixed mortgage rates, but still slightly higher. With the additional rate cuts that are anticipated we could soon see a more typical rate environment where variable rates are below fixed rates, perhaps into the mid-3% range by the end of the year.

Bond yields have not changed as a result of this rate cut - it was already priced in. Fixed mortgage rates are based on bond yields not the Bank of Canada rate. Bond yields are lower by 0.20% since the last rate cut on January 29. Some lenders have lowered their fixed rates a bit in the past couple weeks but we see them stabilizing in a tight range near current levels. Economic news and the outcome of the ever-changing tariff debate will have more impact on fixed rates than the Bank of Canada.

In their accompanying statement the Bank of Canada stated that "The Canadian economy entered 2025 in a solid position, with inflation close to the 2% target and robust GDP growth. However, heightened trade tensions and tariffs imposed by the United States will likely slow the pace of economic activity and increase inflationary pressures in Canada. The economic outlook continues to be subject to more-than-usual uncertainty because of the rapidly evolving policy landscape."

They also stated - "While economic growth has come in stronger than expected, the pervasive uncertainty created by continuously changing US tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest. Against this background, and with inflation close to the 2% target, Governing Council decided to reduce the policy rate by a further 25 basis points".

The economic uncertainty related to tariffs and the potential inflationary impact they may have will make the Bank of Canada's job more difficult in the coming months. As the Bank of Canada has said "Monetary policy cannot offset the impacts of a trade war".

Tariffs imposed by the US and the counter-tariffs from Canada will both increase costs for homebuilders and threaten job security in several industries. Neither of these are positive for the housing market. The housing market has been leaning toward a buyer's market and those that can afford to buy in this environment, now at lower rates, can take advantage. Others may choose to stay put for now until the uncertainty fades. Either way, talk to an experienced advisor and proceed carefully.

The prime rate at the banks will now decline from 5.20% to 4.95%.

You can read the Bank of Canada's full press release here -

https://www.bankofcanada.ca/2025/03/fad-press-release-2025-03-12/

The next Bank of Canada rate announcement is scheduled for April 16, shortly after the next round of US tariffs are scheduled to arrive.

Conclusion

The Canadian bank prime rate plays an important role in the country's financial system, serving as a benchmark rate for a variety of financial products. While the Bank of Canada does not directly set the prime rate, it does have an indirect influence on it through its monetary policy. Banks use the prime rate as a basis for setting interest rates on loans and lines of credit, and borrowers with these variable-rate products, such as variable-rate mortgages, are exposed to interest rate risk. While predicting the future direction of the prime rate is difficult, understanding how it is determined and how it is used by banks and borrowers can help individuals make informed financial decisions.

If you have a variable rate mortgage you need to be aware that rates may increase. However, market expectations are that rates will continue to come down in 2025 although at a slower pace and by smaller amounts. While this reflects current market consensus, be careful not to put too much weight on these predictions. They have been wrong in the recent past and the tariff noise makes predicting the future even more difficult. If you are risk-averse, manage your own affairs without trying to guess where rates are going. Variable-rate mortgages contain risk and are not for everyone. If you are certain in your belief that rates are coming down then a variable-rate mortgage might make sense if you can tolerate the risk financially.

If you are in the market currently for a mortgage, a fixed mortgage rate might be the best solution. Perhaps even a short-term fixed-rate mortgage. With no exposure to interest rate risk during the term of the mortgage, a fixed-rate mortgage is the conservative choice for the majority of us that have a low risk tolerance.

To find great low rates, please click below.

You can also find us at www.frankmortgage.com or at 1-888-850-1337

When the bank of Canada increases or decreases their overnight target borrowing rate, the banks will usually change their prime rate by the same amount within a couple days.

The prime rate does not directly affect fixed mortgage rates. It does affect variable mortgage rates. Most mortgage lenders set their variable mortgage rates at a margin versus the prime rate. This can be either a premium or discount to the prime rate. For example, for a prime, closed variable rate mortgage you might see the rate quoted at prime minus x%. For a heloc you may see a rate of prime plus x%.

All the major banks set their own prime rate. They tend to be the same over time among all the banks. However, for pricing mortgages, TD Bank has a prime rate 0.15% higher than the other banks. Non-bank mortgage lenders will price their variable-rate mortgages using the prime rate from their chosen bank.

Also referred to as the Bank of Canada’s policy rate, this is the benchmark cost of

borrowing set by the Bank of Canada. It is the rate at which Canada’s banks can borrow

money from each other or from the Bank of Canada on an overnight basis. The BoC updates

the rate periodically throughout the year. This rate is the main tool used by the BoC to

set monetary policy. They adjust the rate to regulate the cost of borrowing and demand

for investment and this can be used to control inflation and economic activity.

When the updates are done, change the date on the blog but instead of just showing the

date please say “Updated April 10, 2024”.

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts

Mortgage Brokerage Licensed in Ontario (#13204), British Columbia, Alberta, Saskatchewan (#514115), Manitoba, Nova Scotia, Newfoundland & Labrador, and New Brunswick (#230015752).

© Frank Mortgage 2025 | All Rights Reserved