Canadian Mortgage Rate Forecast For 2024

Mid-Year Update (June 2024)

The Canadian market entered 2024 with high expectations for multiple Bank of Canada interest cuts, starting as early as March or April. Mortgage affordability has been impaired by the current high rates and market participants are anxious for some rate relief. It has not played out as initially predicted but rate cuts have finally arrived.

On June 5, the Bank of Canada announced the first rate cut of the year, lowering their target lending rate from 5.0% to 4.75%. Banks followed suit and lowered their prime lending rates from 7.20% to 6.95%. This has resulted in lower variable mortgage rates and fixed rates have also declined a bit. Where do rates go from here?

There are two key points we want to emphasize when trying to predict lower interest rates:

- A decline in the Bank of Canada rate will lead to a decline in variable-mortgage rates but does not necessarily mean a similar decline in longer term bond or fixed mortgage rates;

- The current level of fixed rates is close to historical averages. It is the short-term rates, which are influenced by the Bank of Canada, that are unusually high. These rates determine variable-mortgage rates.

A return to the abnormally low rates we experienced in recent years is not likely. Absent any sudden change in inflation or economic growth, bond yields will tend to range between 2% and 4% over time. The five-year Canada bond yield today is about 3.5%. Shorter term bond yields are higher than longer term bond yields. This is called a ‘yield curve inversion’. Normally, short-term yields are lower than longer term yields. In other words, the yield curve is usually positively sloping. We will eventually return to that but to do so means the short-term yields have to come down significantly. This will be good for variable-mortgage rates.

Before talking about the predictions for the remainder of 2024 let’s look into some background information regarding mortgage rates.

What Interest Rates Affect Mortgage Rates?

There are two key underlying market rates that mortgage borrowers should be aware of:

The Prime Rate

The prime rate is defined as the interest rate commercial banks charge their most credit-worthy customers. It serves as a benchmark rate for setting the rates on a variety of financial products, including mortgages, personal loans, and lines of credit. The prime rate is influenced by several factors, including inflation, economic growth, and the supply and demand for credit.

The prime rate is determined by the banks themselves, and it is typically set at a level that is 1.5 to 2.5 percentage points above the overnight lending target rate set by the Bank of Canada. The prime rate is currently (June 10, 2024) 6.95%. It recently declined from 7.20%, the first decline in over four years.

The Five-Year Canada Bond Yield

There are a variety of Canada government bonds that trade daily in the bond market. They have terms to maturity ranging from overnight to 30-year bonds. The five-year Canada bond is a benchmark pricing bond for mortgages. This is because mortgage funding vehicles like mortgage-backed securities are priced off this bond.

The bond market sets the price of the bonds, and the bonds are forward looking. This means their current price is somewhat based on bond investor’s view of the future economic prospects of the country that issued the bonds. Factors like economic growth, employment and inflation influence the price of the bonds. The five-year government of Canada bond yield is currently 3.52% (as of June 10, 2024) and was as high as 4.42% in October 2023.

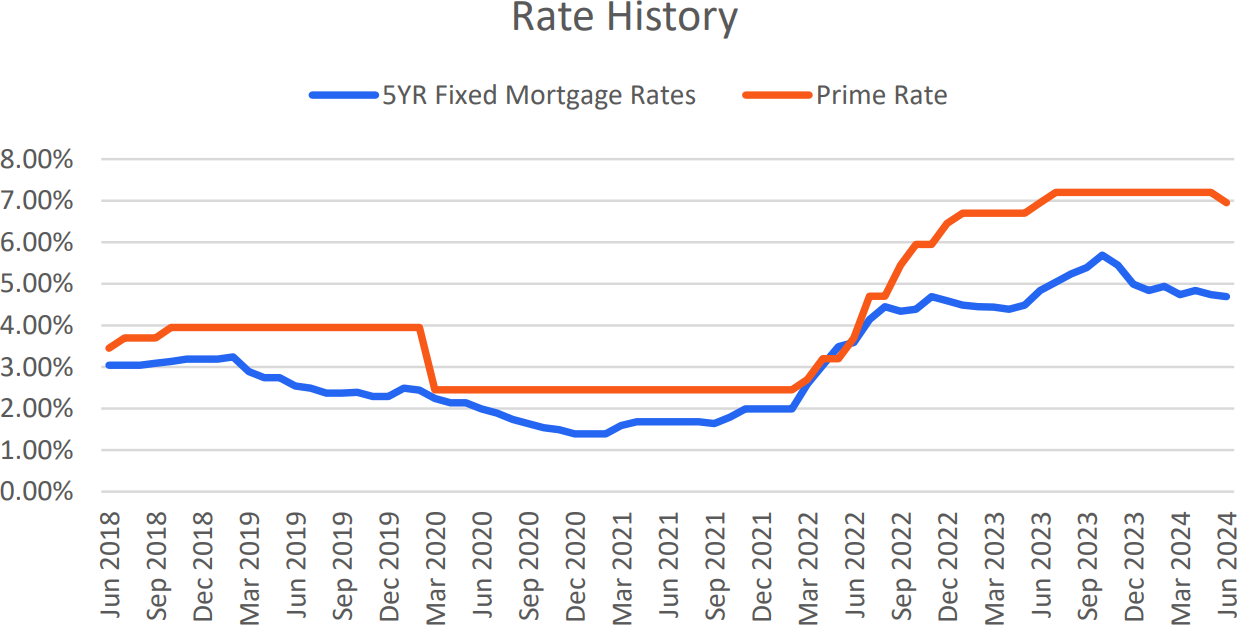

Recent History of Canadian Mortgage Rates

Rates have been lower than historical averages since the economy exited from the financial crisis. There have been some ups and downs, none more pronounced than the reduction of rates in response to the covid lockdowns.

Unfortunately, an extended period of low rates combined with massive government stimulus in response to the covid lockdowns fueled a period of inflation. In response, central banks rapidly increased rates in 2022, with the Bank of Canada raising their target interest rate by 4.0% - the largest ever one-year increase. They then raised it another 0.75% in 2023 and made their first cut in over four years on June 5, 2024.

Being a predictor of the future, the bond market responded to inflation as well and bond yields rose. This pushed fixed mortgage rates higher.

With the June rate cut, the Bank of Canada has set expectations for more rate cuts in the second half of 2024. Anticipating lower inflation, the bond market has rallied, meaning that bond yields have declined.

What Have Mortgage Rates Done Recently?

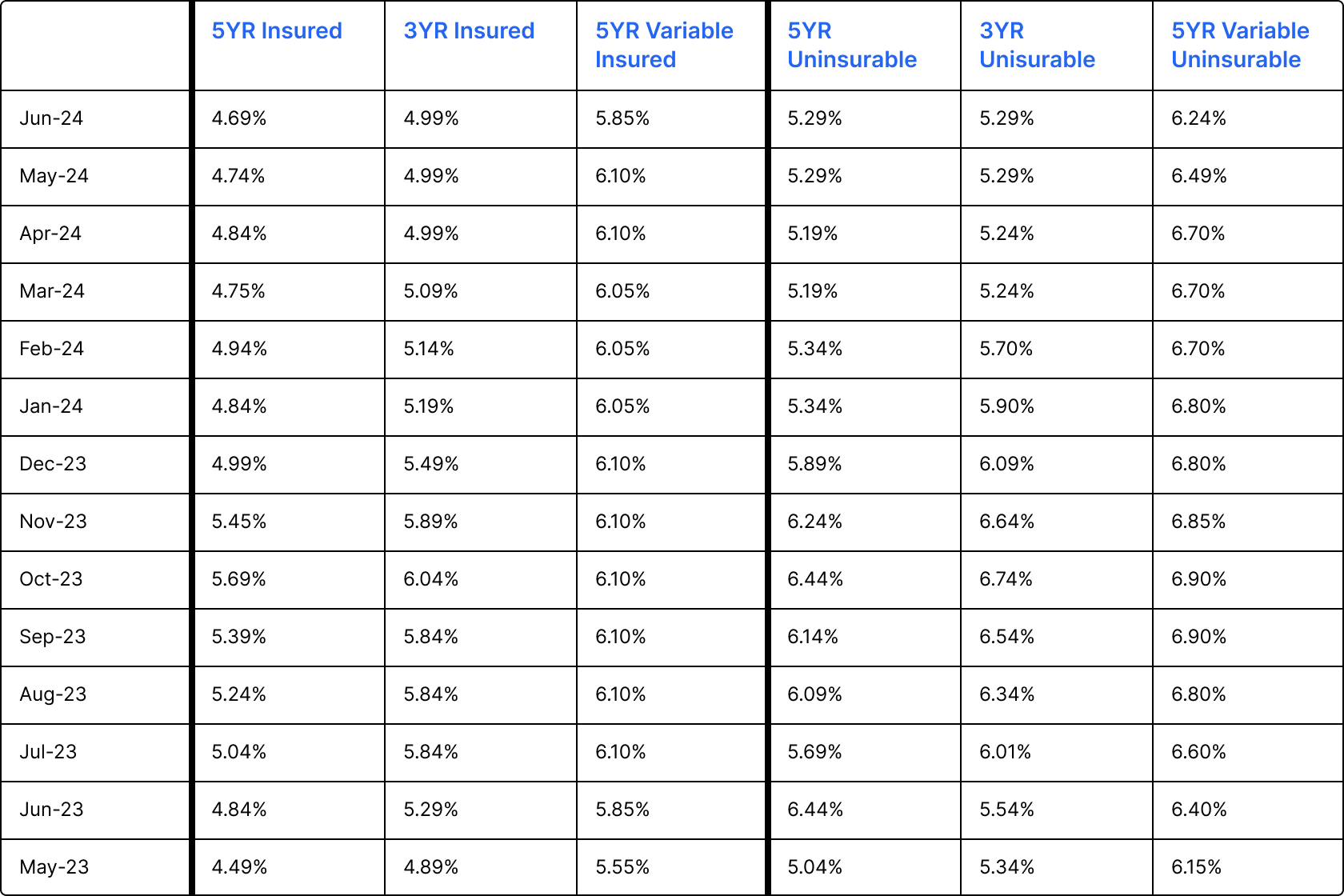

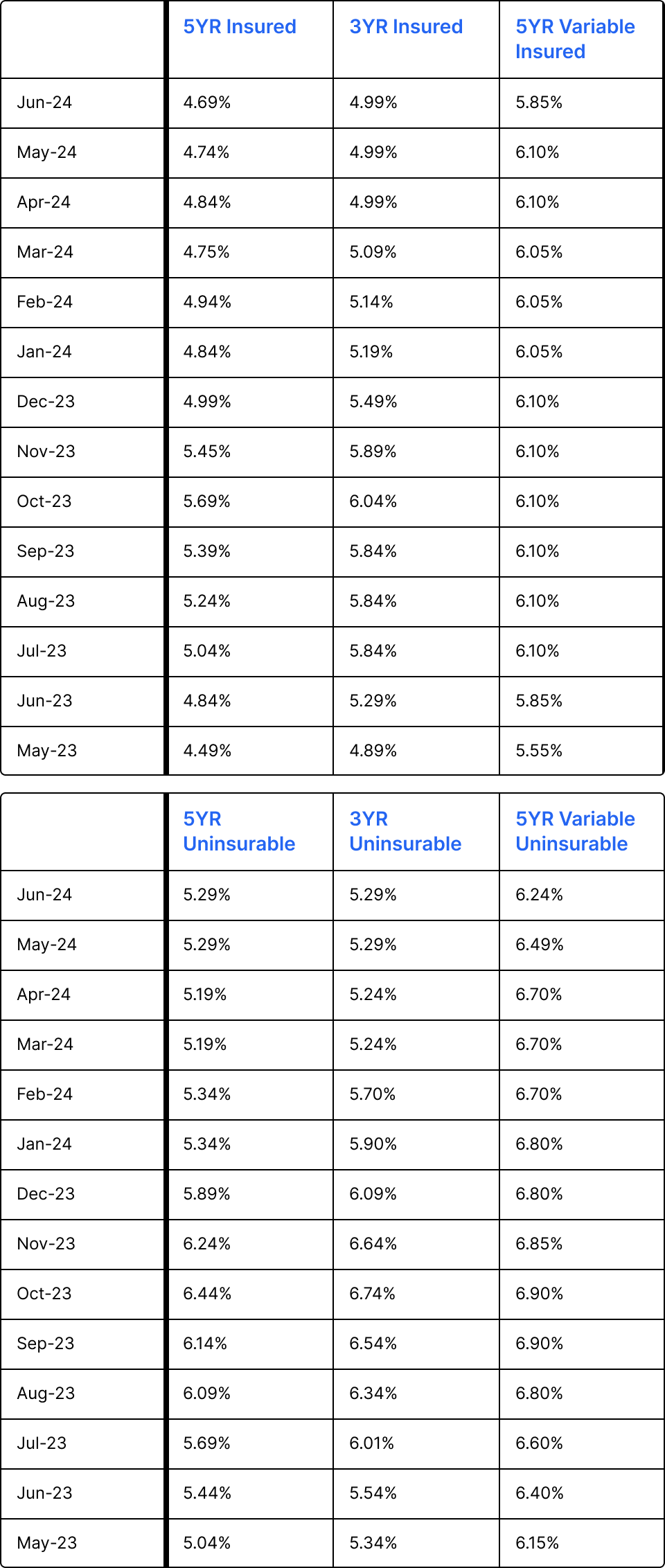

Fixed mortgage rates have declined by 1.0% since their peak in October 2023. The best five-year fixed mortgage rates are now closed to 4.6%. Lenders lower their rates as their funding costs decline. The government five-year bond represents those funding costs.

Variable mortgage rates recently declined by 0.25% due to the rate cut by the Bank of Canada. They had remained unchanged since they last went up in July 2023. Variable rates will only decline further in response to Bank of Canada rate cuts.

As the table below shows, fixed mortgage rates peaked in October 2023 and variable mortgage rates peaked in July 2023. While fixed mortgage rates have declined as bond yields have declined, variable rates remain high.

Recent Canadian Mortgage Rates

Will Mortgage Rates Continue to Decline in Canada in 2024?

There are many pundits and bank analysts that are paid to make predictions. It is a difficult game, and they are wrong more often than they are right. Just look at recent year’s forecasts to see how wrong they were in 2023, 2022 and 2021. Nevertheless, their predictions are often viewed by market participants as a guide.

At the start of the year the major banks expected rates to decline by 1% to 1.5%. Those predictions are now between 0.50% and 0.75%. Smaller aggregate rate cuts are expected but any rate cuts are good news for borrowers.

The banks do not expect there to be any material changes to fixed rates in 2024. The five-year Canada bond yield is 3.52% today and most banks expect it to be between 3% and 3.5% at year end. Flat to slightly lower is the expectation.

If these projections are accurate then borrowers can expect variable mortgage rates to be lower by between 0.5% to 0.75% by year end. This should provide some much-needed payment relief for many. Fixed mortgage rates may not change materially. We may see some variability up or down in fixed mortgage rates but not by much, maybe 0.25% to 0.50% in either direction.

Could Mortgage Rates Increase in Canada in 2024?

If the bank analyst’s views on interest rates are accurate then an increase in mortgage rates is unlikely, although some minor movement up and down is possible with fixed mortgage rates. The risk to these forecasts is the possibility that the inflation story is not yet over. There are some concerns that core inflation remains stubbornly high, oil and gas prices could move higher, the US economy remains strong and global conflict and uncertainty could put upwards pressure on inflation. Not to mention that excessive government debt is also inflationary.

The pundits completely missed the inflation story when it started to take hold in the latter half of 2021. Are they missing it again? We do not profess to know, but caution everyone to keep a close eye on inflation numbers as a guide to where interest rates may go. Hopefully, the analysts are right this time.

How Can You Stay Informed About Interest Rates?

The Bank of Canada interest rate announcements are news to keep an eye on. They make these announcements on preset dates. The remaining schedule for 2024 is:

| Wednesday, July 24, 2024 |

| Wednesday, September 4, 2024 |

| Wednesday, October 23, 2024 |

| Wednesday, December 11, 2024 |

If you would like to keep track of the five-year government of Canada bond you can track it for free on the internet. There are many websites that let you do this, and an online search will help you find one. Here is a link to one such site - Marketwatch.com/investing/bond/5yr

For current mortgage rates you can go to www.frankmortgage.com to see our mortgage rates that are updated daily.

You can also sign up for our monthly mortgage market update email. It provides a summary of monthly activity in the mortgage and housing markets, including an update on interest rates. You can sign up here.

Frank Mortgage's View on 2024 Mortgage Rate Predictions

We believe that the Bank of Canada will announce further cut rates in 2024 but are reluctant to estimate that there will be more than two additional cuts. This will help current variable-rate mortgage holders and improve mortgage affordability, but these cuts will not make a significant difference for many borrowers struggling with affordability. Further rate relief in 2025 will be required and, until then housing affordability will continue to be the main topic of discussion.

We are optimistic for a more active housing market in the latter half of 2024 as the Bank of Canada cuts rates and signals for more cuts ahead.

Most of the rate decline that matters already occurred as five-year fixed mortgage rates have declined by 1.0% since October. Five-year mortgage rates may be somewhat range-bound for the remainder of the year, perhaps ranging between 4.5% and 5.0%.

Fixed mortgage rates are materially lower than variable rates. The gap remains over 1%. Second-half 2024 rate cuts by the Bank of Canada may start to close that gap but rates will need to decline more significantly than projected for variable rates to make sense again. To break even on a variable-rate mortgage today would require rates to decline by more than 1.50% in the next 18 months.

We expect most customers to continue to favor fixed rates since variable rates are higher, rate uncertainty persists, and homeowners remain justifiably risk adverse.

We expect the capital markets in 2024 to be volatile. There are so many unknowns with a housing crisis, foreign wars, a US election, government debt continuing to grow and general economic uncertainty. This will all affect rates and the housing market. The path to better mortgage and housing markets might be a little bumpy so borrowers should avoid taking unnecessary risks and focus on affordability and safety.

We also caution all customers to take the interest rate predictions with a grain of salt. The bank analysts that make market predictions like those noted above got it wrong in 2023, 2022 and 2021. What are the odds they get it right this year? Do your own research and seek out opposing views to get the whole picture to inform your own opinions and decisions.

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.