Monthly Market Update - March 15, 2024

Variable-mortgage rates remain flat and fixed rates have declined since last month. Housing sales slowed in February but are expected to pick up as buyers return to the market in anticipation of lower rates and a strengthening market.

The Bank of Canada held rates unchanged at their scheduled announcement on March 6. They have not changed rates since July 2023. They remain cautious about persistent inflation pressures and did not give any signals that rate cuts are imminent. Market expectations are for rate cuts to begin in either June or July.

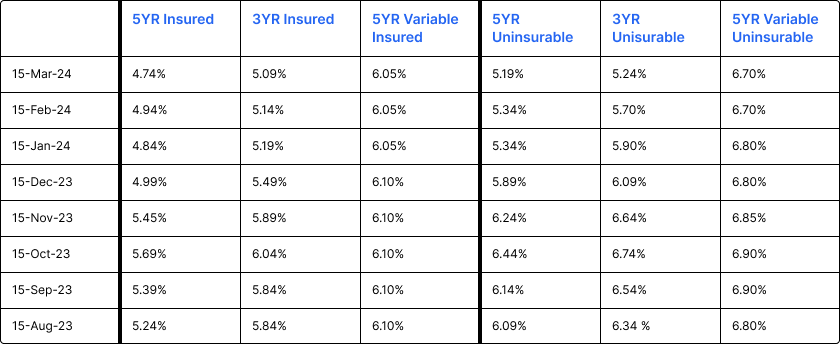

Five-year bond yields have fluctuated but remained relatively unchanged over the last month. Some fixed mortgage rates have declined again as lenders become more aggressive in the lead up to the spring market. The lowest insured, fixed mortgage rates remain below 5%.

Variable rates remain high and will stay there until we see the anticipated rate reductions by the Bank of Canada.

Housing sales declined in February and new listings were up. Sidelined buyers appear to be re-entering the market.

Mortgage Market

The prime rate remains at 7.20%

Fixed mortgage rates declined in early March, improving mortgage affordability. Five-year insured mortgage rates below 5% are available with multiple lenders

The five year government bond yield is 3.65% today, which is only 0.02% lower than last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

Fixed mortgage rates have declined in the past month

Fixed mortgage rates are more than 1% lower than variable mortgage rates

Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

CMHC axed the little-used First-Time Home Buyer incentive. No applications will be accepted after March 21, 2024

"It is still too early to consider lowering the policy interest rate" - BoC

"We believe that our policy rate is likely at its peak for this tightening cycle. If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year" - BoC. In other words, they think rates have peaked and should begin to decline sometime this year

Bank of Canada offers few hints about timing of rate cuts - Globe and Mail

Shelter costs are the single biggest factor preventing a return to 2% inflation - TD

Reaching 2% inflation possible by the summer - National Bank

The Bank of Canada's recent interest rate hikes are starting to pinch Canadian households, with a marked slowdown in credit growth and a rise in financial stress - CIBC

Canadian mortgage holders increasingly missed payments in Q4 2023 - Equifax

Inflation in Canada declined to 2.9% in January. February inflation is expected to be slightly higher. The data will be released on March 19

Housing Market

The MLS Home Price Index (HPI) was flat month-over-month in February 2024, ending five straight months of decline. The actual (not seasonally adjusted) national average sale price was up 3.5% year-over-year. The actual national average home price was $685,809 at the end of February 2024.

Housing Sales declined 3.1% month-over-month in February 2024. Actual (not seasonally adjusted) sales were up by 19.7% over the prior year, February 2023.

Housing Market Headlines

New listing activity in February was up 1.6% month-over-month - CREA

Nationally, there were 3.8 months of housing inventory for sale at the end of February 2024. The long-term average is closer to five months - CREA

“With so much demand having piled up on the sidelines, the story will likely be less about the exact timing of interest rate cuts and more about how many homes come up for sale this year.” - CREA

Experts say first-time buyers are back — and prices could jump 6% in Toronto this year - Toronto Star

BC's house flipping tax would have minimal impact on home prices, but decrease sales by 1.7 percent. - BCREA

Competition is heating up in the housing market - Globe and Mail

A poll involving 17 analysts predicts a modest 1.2% increase in average home prices this year, following a 5.5% decline last year, with an anticipated 3.3% rise in 2025. - Reuters

"After two years of mostly quiet resale housing activity there's a feeling that things are about to pick up" - CREA

"if we don’t grow supply, we’re not going to solve the housing problem.” - BoC

It is estimated that half of all wealth generated in Canada in the last 3 decades has come from homeownership - RBC

Rental demand from international students will slow this year, but won't fall - RBC

Canada's housing correction has likely run its course - Financial Post

Do you have questions about a new mortgage, renewal or refinancing?