Monthly Market Update - December 15, 2023

The rate hiking cycle appears to be over just as both housing sales and prices show weakness. Housing sales and prices declined nationally in November, driven mostly by declines in Ontario, offset by strength in other regions, particularly Alberta.

The Bank of Canada held rates unchanged at their scheduled announcement on December 6, but they cautioned the market about being too optimistic about rate cuts. The BoC remained cautious, expressing concern about inflationary pressures and leaving the door open to further increases. Their next rate announcement is scheduled for January 24.

Bond yields declined further over the past month, dropping sharply again on Dec 13 after the US Federal Reserve stated that rate cuts are likely in the latter half of 2024. Fixed mortgage rates have been declining in Canada but more slowly than the decline in bond yields. We expect fixed mortgage rates to decline further in the near term while variable rates remain unchanged.

Housing markets are local as evidenced by the differing results across regions. Both buyers and sellers sit on the sidelines in Ontario while activity remains reasonably healthy elsewhere. Housing affordability remains a challenge but lower fixed rates will help.

Mortgage Market

The prime rate remains at 7.20%

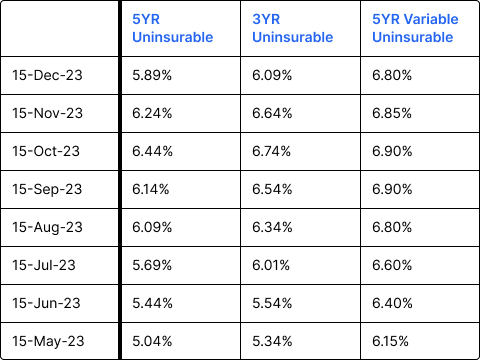

Fixed mortgage rates declined this past month, with five-year insured mortgage rates available below 5% for the first time since June, as shown below:

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

Fixed mortgage rates continue to decline in response to the decline in bond yields.

Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates.

Mortgage borrowers renewing in 2024 could see average payment increases of 30% - BMO

Bank of Canada likely finished with rate hikes - CIBC.

The Federal Government announced their Canadian Mortgage Charter which aims to assist borrowers experiencing financial difficulty. The truth is there is little new in this charter - see our evaluation here: https://www.frankmortgage.com/blog/the-canadian-mortgage-charter.

CMHC has confirmed that the mortgage stress test is not required for mortgage switches or transfers for insured mortgages. This is helpful for renewing insured mortgage borrowers seeking flexibility, a new lender or a better rate.

OSFI recently confirmed that the stress test (qualifying at the greater of 5.25% or the mortgage rate plus 2%) will continue to apply for mortgage switches or transfers when the mortgage is uninsured. Unfortunately, uninsured borrowers will not enjoy the same flexibility at renewal as insured borrowers.

The Bank of Canada overnight rate could be 2 points lower if not for Canada's excessive government spending - Scotiabank.

The government disclosed that over 250,000 Canadians have opened a First-Home Savings Account (FHSA). The tax advantaged savings these accounts offer to first-time homebuyers is proving popular.

Inflation in Canada fell to 3.1% in October, down from 3.8% in September. November inflation data will be released on December 19.

Economic growth declined in Q3 with negative 0.3% GDP growth.

Housing Market

The MLS Home Price Index (HPI) was down 1.1% month-over-month in November 2023. The actual (not seasonally adjusted) national average sale price was up 2% year-over-year.

Housing Sales were down 0.9% month-over-month in November 2023. Actual (not seasonally adjusted) sales were down by 0.9% over the prior year, November 2022.

Housing Market Headlines

New listing activity in November declined 1.8% month-over-month - CREA

Nationally, there were 4.2 months of housing inventory for sale at the end of November 2023. The long-term average is closer to five months - CREA

Declines in home prices are primarily an Ontario phenomenon - CREA

Canadian home sellers are joining buyers on the sidelines - CREA

Projections for house prices going forward are mixed, as can been seen by these headlines:

House prices projected to increase 5% to 6% in 2024 - Royal LePage

Housing prices seen to stabilize in 2024 - RBC

Canadian house prices could drop 10% over the next few months - TD Bank

Undeterred by affordability challenges, consumer confidence in home ownership as an investment remains steady year-over-year. 73% of Canadians believe that home ownership is the best long-term investment -RE/MAX

The Federal Government announces plans to crack down on non-compliant short-term housing rentals, such as Airbnb.

The percent of homes bought by investors has increased from 20% to 30% since 2014. The percent bought by first-time homebuyers has declined to 43% from 50% - The Bank of Canada

Adult children of homeowners are more than twice as likely to own a home as children of non-homeowners - Statistics Canada

Do you have questions about a new mortgage, renewal or refinancing?